Our Accounting course is designed for business students, interns, job-holders & entrepreneurs who wish to understand how accounting & taxation works in real corporate world.

Rs. 5,000/-

A course designed for business students, interns, job-holders & entrepreneurs who wish to understand how accounting & taxation works in

real corporate world.

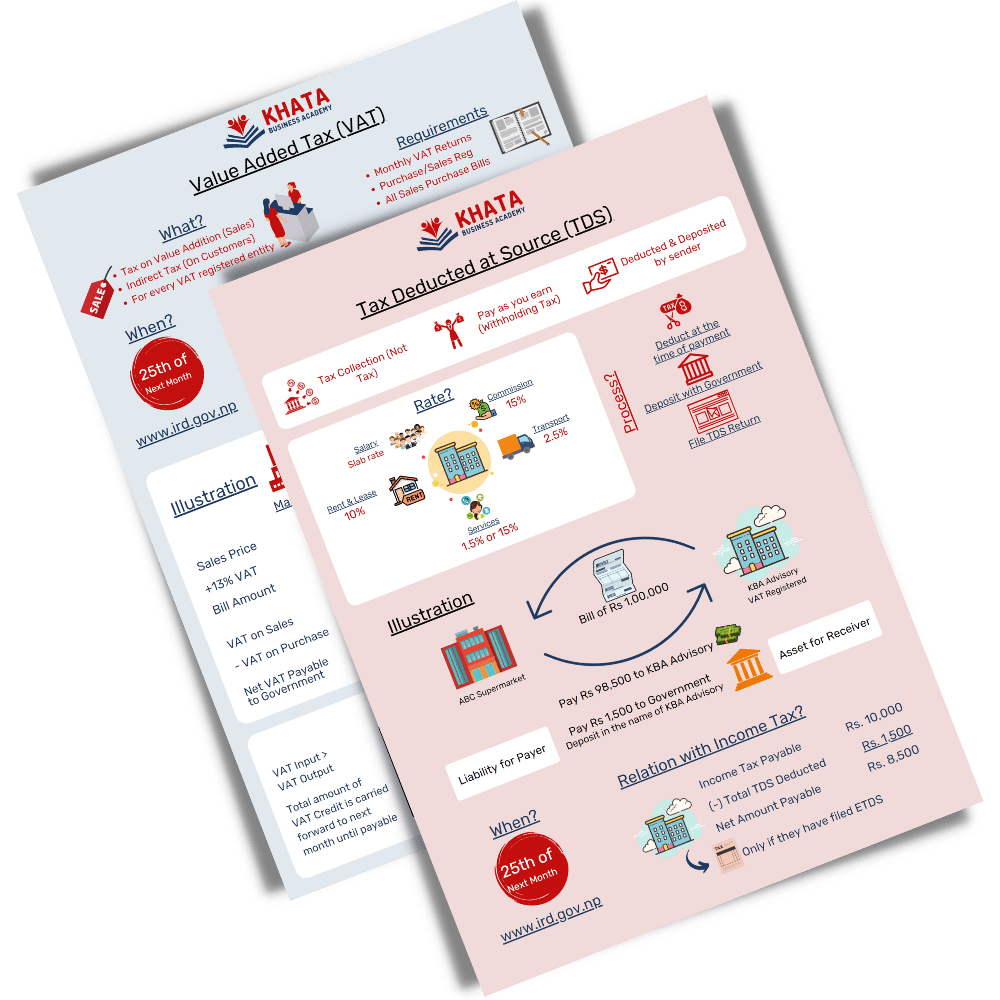

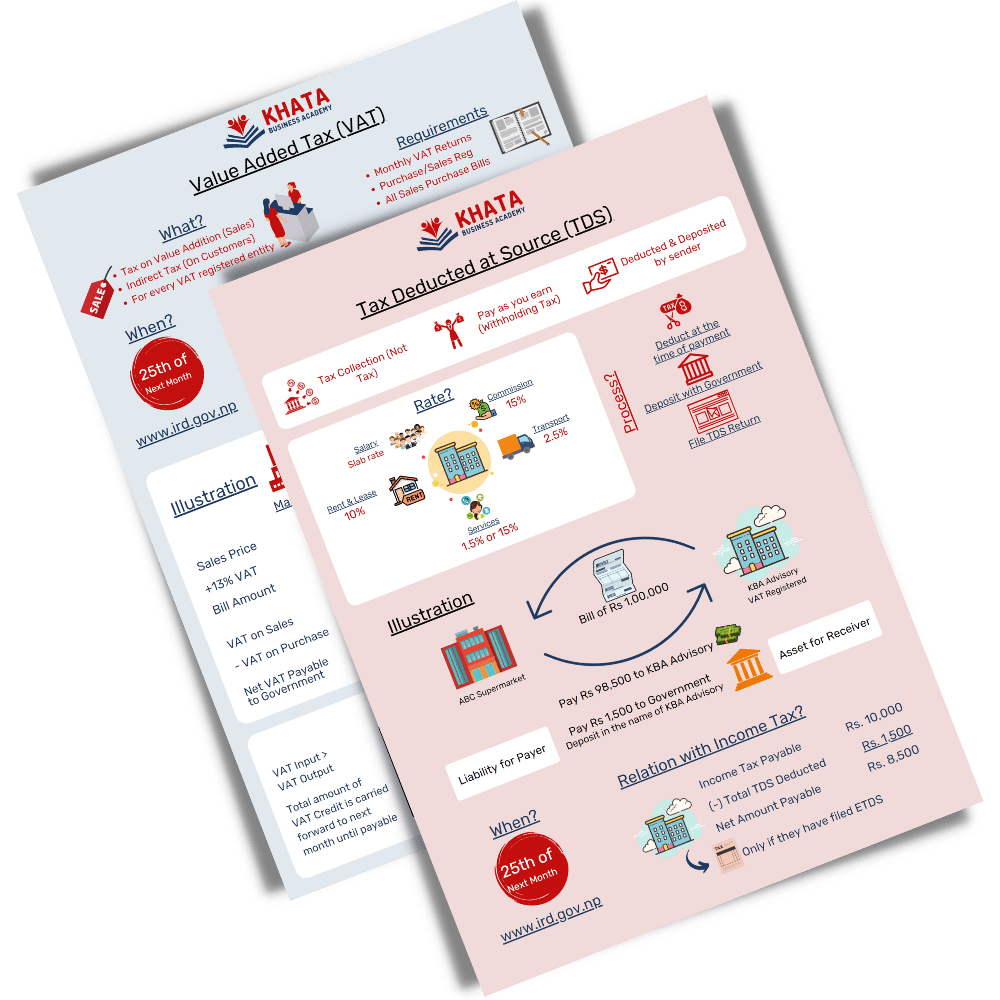

KBA provides you with multiple E-Books and Quick References for your conceptual clarity. Our study materials are often designed with practical illustrations and summarized versions.

Only obtaining theoretical accounting knowledge is not adequate for long-term career growth. We help you with multiple practice templates where you can experiment & learn with real data.

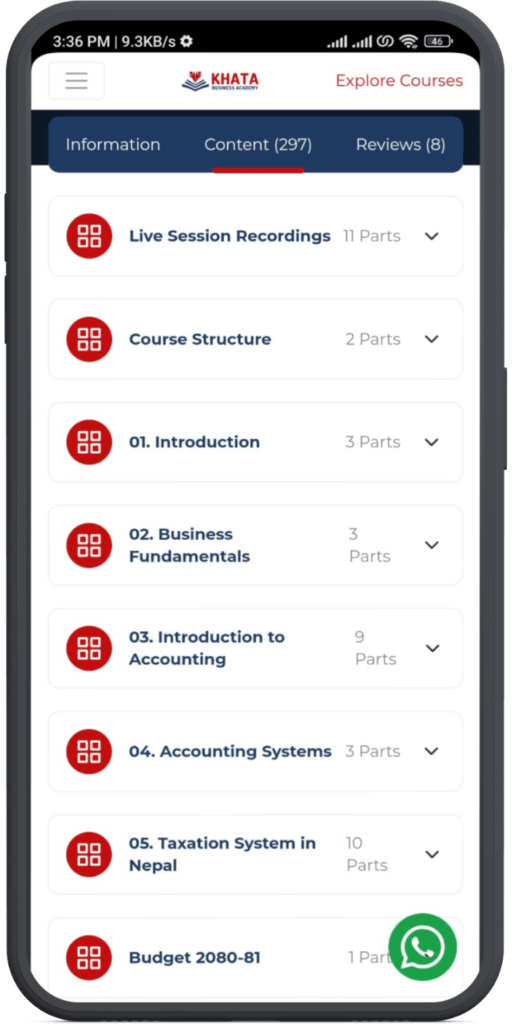

Your learning experience will be maximized with our live sessions in addition to on-demand concept videos. You can interact, discuss real-life queries and clear your confusion.

KBA provides you with multiple E-Books and Quick References for your conceptual clarity. Our study materials are often designed with practical illustrations and summarized versions.

Only obtaining theoretical accounting knowledge is not adequate for long-term career growth. We help you with multiple practice templates where you can experiment & learn with real data.

Your learning experience will be maximized with our on-demand concept videos in addition to live sessions. You can interact, discuss real-life queries and clear your confusion.

This course is exclusively developed and delivered by CA Bipin Lamsal. He qualified for his Chartered Accountancy from ICAI, India in 2017. After collecting abundant experience in the field of Corporate Finance & Financial Reporting from Deloitte (One of the Big Four Consulting Firm in the World), he returned to Nepal and co-founded Khata Business Academy. He has also been involved in the preparation of several other courses in KBA like NFRS For Accountants, Corporate Finance Practicals etc.

This extensive practical accounting course aims to bridge the gap between the college education and real life accounting situation that every accountants have to face when they first start their career. The course has been designed and upgraded batch after batch enabling students to fundamentally grasp the concepts of Accounting, Debit & Credit Rules, Chart of Accounts, Taxation terms and thier accounting effects(VAT, TDS, etc)

You as a student shall be given live task to act as a virtual accountant for a company, asking to perform tasks starting from recording transactions (sales, purchase, receipts, payment etc.) with proper documentation to analyzing and presenting reports in an Applicable Reporting Framework, required & used by Management/ Executives in financial decision making.

After successful completion of the course, the students will be able to learn:

Anyone who wants to learn the practical aspects of accounting can join us. Basic work experience will be an added advantage to get a better understanding. This course is for you:

You get a job when you make the interviewer convinced that you are right candidate for the job. This course will certainly groom your skills and help you take interview like a semi-experienced accountant.

Upon completion of this program, we assist you on resume writing and job placements.

You are a lucky one to have been offered course at discounted rate. In addition, we do have referral reward program. Refer the course to your near and dear ones (of course after you like it) and get 10% ff on any other course you wish to take from KBA.

“Learning Accounting Practically is our major focus. In addition to accounting knowledge there are certain things that an accountants must be aware of which we have covered for you as well:

a) Resume Writing – Resume does matter! Employer do look for the qualities they expect in the resume so first impression via resume is important

b) Check List – As an accountant, there’s lot to do other than recording & reporting. Don’t Worry we have covered you for that”

Please fell free to fill up the form below “Enroll Now” section or contact us directly at 9801074002 for payment and other enrollment matters.

Please send us screenshot or pdf of payment proof in “Enroll Now” section. We receive payments in following modes:

KBA has got you covered! We have a range of Accounting & Taxation courses which you can choose according to your career requirement.

WhatsApp us