Hey accountants,

We are here to talk to you about VAT, or value-added tax. VAT is a consumption tax that is levied on the value added to goods and services at each stage of production and distribution. In Nepal, VAT is administered by the Inland Revenue Department (IRD) as per Value Added Tax Act, 2052.

VAT is a broad-based tax, which means that it applies to a wide range of goods and services. However, there are some exemptions, such as basic necessities and exports on which VAT is not applicable. The standard VAT rate in Nepal is 13%.

When a business sells a taxable good or service, it is required to charge VAT on the sale. The business can then claim a credit for the VAT that it paid on its inputs, such as the cost of goods sold, fixed assets and business expenses. At the 25th of the next month, the business must file a VAT return and pay any VAT that is due.

Let’s dive deep into VAT now:

Rate of Value Added Tax (VAT) in Nepal

Unlike many other countries, including our neighbor country India, Nepal has a single rate for VAT Applicable goods and services, i.e., 13%. It is calculated as 13% of the net selling price of goods and services, which will be added to the invoice to the customer.

Since VAT is levied on every stage of the Supply Chain (Manufacturing stage, Distribution stage, Retail Sale stage), it ultimately increases consumers’ price of goods and services. To avoid the effect of high prices on essential goods and services, the concept of VAT Exempt Goods and Services and Zero-Rated Transactions have been introduced in the VAT Act.

1. VAT Exempt Goods & Services

Goods and Services listed in Schedule 1 of the Act are exempt from VAT. This schedule majorly covers essential goods and services such as Agricultural Products, Basic Needs, Medicine and Medical Services, Education, Air Transport and Passenger Transportation services, and other goods or services that government considers necessary. Business Entities involved solely in these goods and services are exempt from being registered in VAT. For example, a hospital, school, agriculture farm, etc., are not required to be registered in VAT.

2. Zero Rated Transactions

Transactions listed in Schedule 2 of the Act are termed Zero-Rated Transactions. A few of such transactions are given below:

- Export of goods and services,

- Sales of inputs to industries running in SEZ (Special Economic Zones),

- Machines or tools produced by the domestic industry and sold to hydro projects, etc.

VAT is charged at the rate of 0% on Zero Rated Transactions. For example, a business entity manufacturing shoes will charge VAT at 13% on sales made inside the country, while the same shoes, when exported outside the country, VAT are levied at 0%.

Any other Sales of Goods and Services not listed in Schedule 1 or Schedule 2 will attract VAT at the rate specified by the ACT, i.e., 13%.

| Goods & Services | VAT Rate |

| Items specified in Schedule 1 of the Act | No VAT |

| Items specified in Schedule 2 of the Act | 0% |

| All Other Items | 13% |

VAT on Import

Many people think that only custom duty applies to the import of goods. This is not true. In addition to customs duty, VAT is also applicable to import items not included in Schedule 1 and 2 of the Act. When VAT is applicable on certain goods produced by domestic industry, VAT must be applied to goods of similar nature produced by foreign countries.

How does Government regulate VAT and manages the collection?

Regulation of VAT starts with the criteria for its’ applicability to a business entity.

Any Business Entity meeting the following criteria has to compulsorily register in VAT:

| Nature of Business | Criteria |

| Involves Physical Goods only | Annual Turnover exceeding Rs. 50 lakhs |

| Involves Services only | Annual Turnover exceeding Rs. 20 lakhs |

| Involves both Goods and Services | Annual Turnover exceeding Rs. 20 lakhs |

VAT Registration Process in Nepal:

A Business entity can register in VAT either immediately after business registration or after a certain period of time on meeting the VAT applicability criteria.

Following are steps to be followed for registration in VAT:

- Fill up the online VAT Registration form via the official site of IRD. Here we need to fill in details such as business registration number, registration date, registered address, director or proprietor personal information, Estimated Annual Turnover, etc.

- After submitting the online form, the following documents should be submitted to the IRD office :

- Online application of VAT Registration with submission no.

- Photocopy of Business Registration Certificate and related documents

- Address Proof like Rent Agreement or Lalpurja copy

- One of the Directors or the Proprietor has to visit IRD along with these documents in physical form.

- On submitting the documents, the IRD officer verifies the information and proceeds with the biometric of the Director or Proprietor present in the office.

- Once approved, the VAT registration Certificate is printed and provided to the business owner.

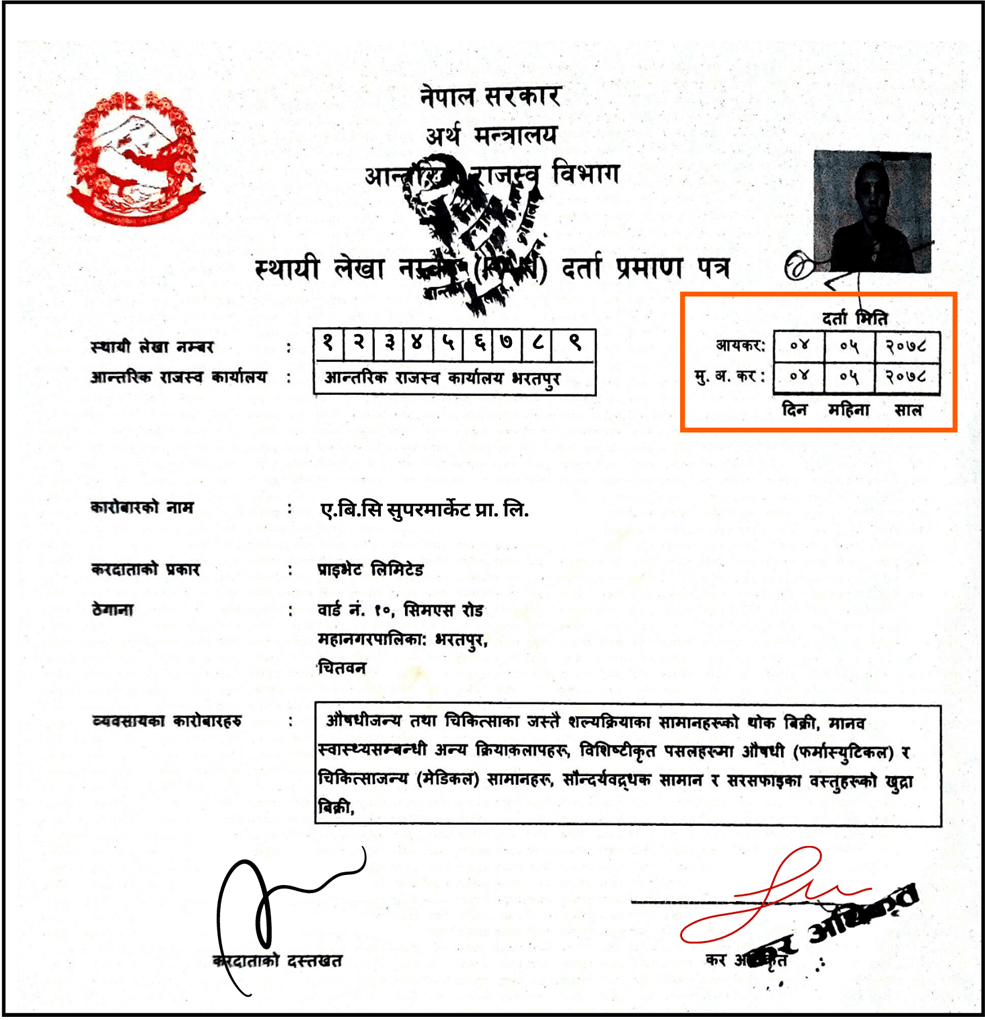

Difference between PAN & VAT

We can observe in the above figure that VAT No. is the same as PAN No. and VAT Certificate is no different than PAN Certificate. The major difference between PAN and VAT is that PAN registration is compulsory for every business entity while VAT Registration is Voluntary until the business entity meets the turnover criteria.

Compliance Requirements for VAT registered Business Entities

Compliance requirement increases for a business entity registered in VAT.

A. Levy VAT on sales and make payment to the authority

A business entity registered in VAT will need to:

- levy VAT on every sale made of VAT Applicable Goods and Services

- Calculate VAT Payable Liability for a month and by the 25th of next month they should

- File VAT Return

- Make Payment of VAT Liability to Government

B. Invoicing Requirements:

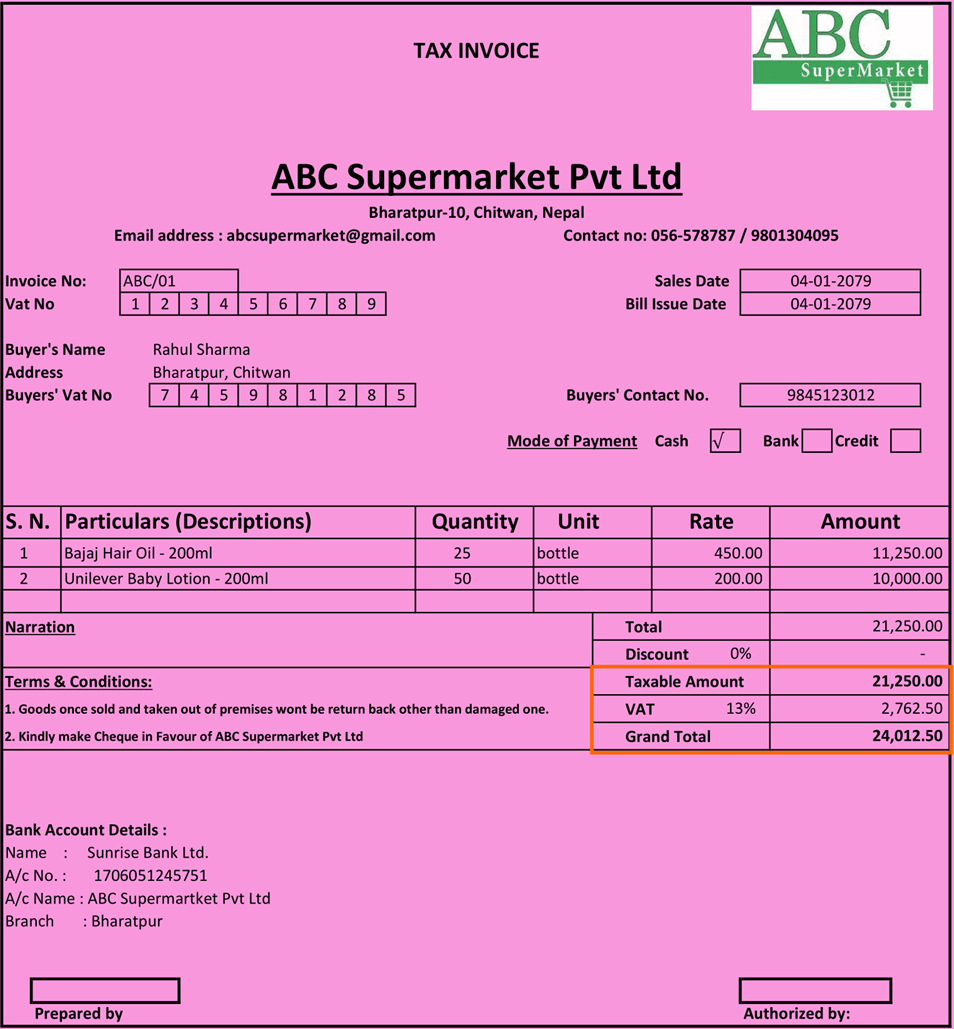

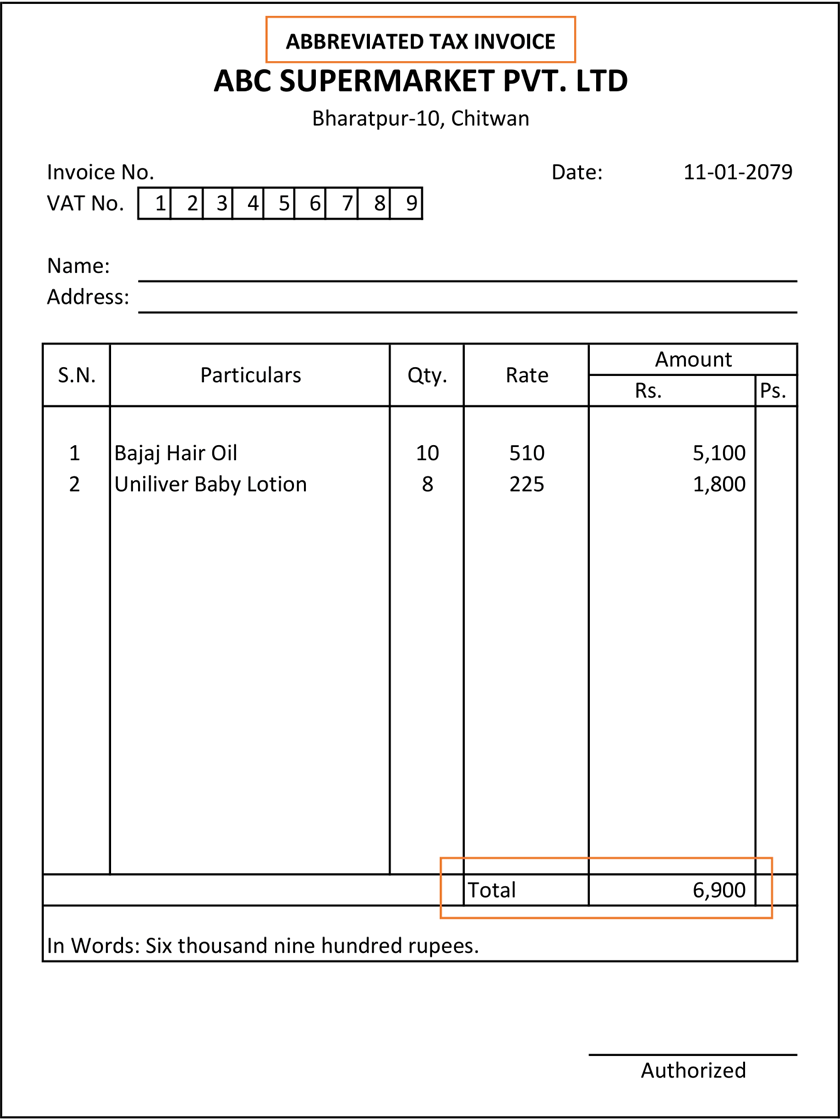

VAT is applicable on point of sales which means it is charged on the sales price of goods and services. It is required to be shown as an addition to the sales price in the invoice provided to the customer shown below:

Following are the compliance requirement relating to invoices applicable to VAT-registered entities:

- VAT No of the seller should be mentioned.

- The invoice should be drawn in chronological order starting from 01

(Remember no invoice no can be left blank, and invoices cannot be drawn on expired or future dates)

- The invoice should be drawn in chronological order starting from 01

- VAT Rate and Amount should be mentioned in the invoice.

Abbreviated Invoice:

For a business entity that deals with a high inflow of retail customers and needs to display the final price, inclusive of VAT to attract customers, it might not be practical to draw a VAT Invoice for every sale made. Restaurants, Grocery stores or supermarkets, etc are some examples of such entities. These business entities can seek approval from the revenue department to use abbreviated invoices. In such invoices, the VAT amount is not shown separately and the price of goods and services sold is inclusive of VAT. However, upon request by the customer, they need to issue a proper VAT Invoice.

C. Maintaining "Maskebari" Records

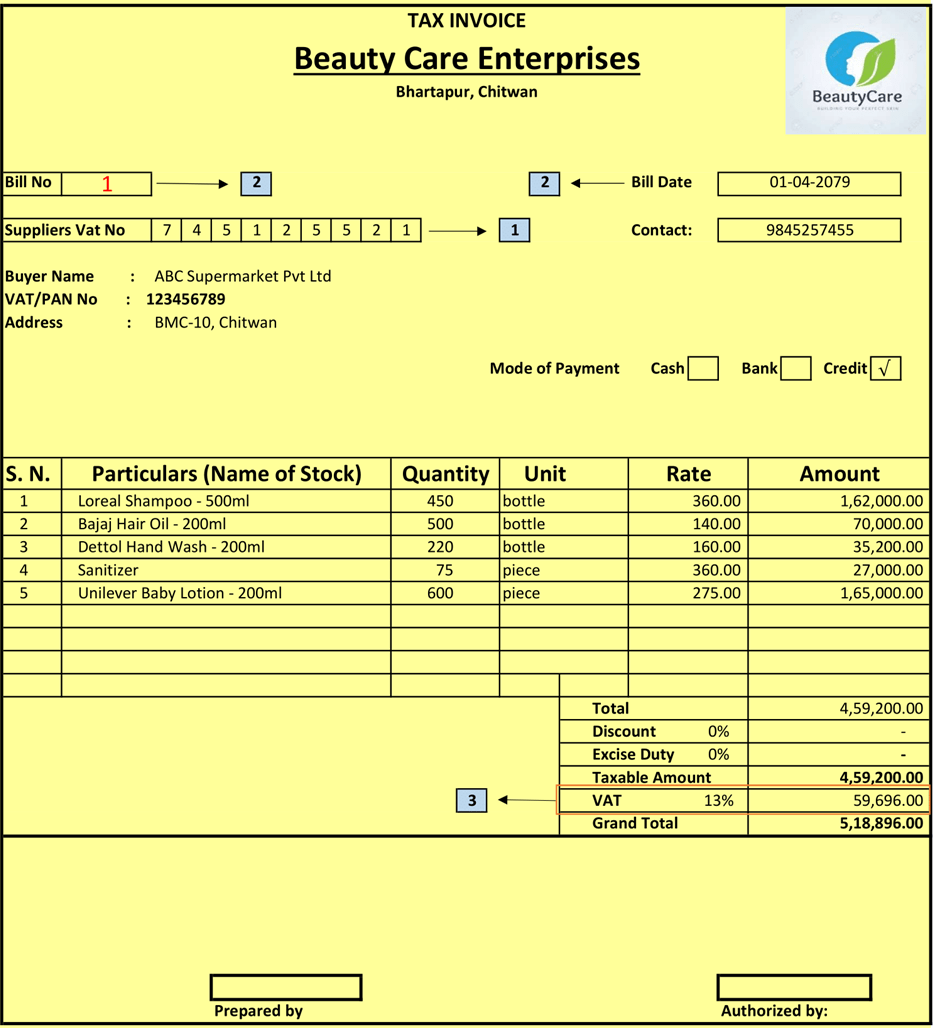

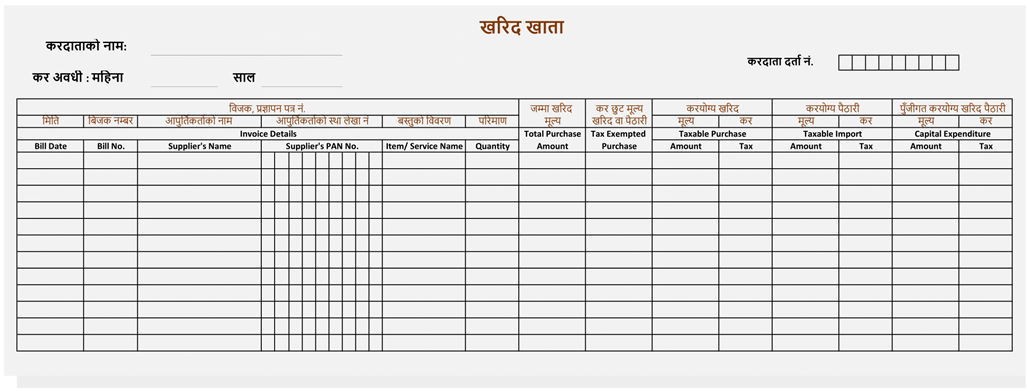

i. Kharid Khata

This book maintains a detailed record of each purchase made in a month. The purchase should be classified as either stock, fixed asset, import, or purchase of VAT exempted items. Any purchase return should also be recorded as a negative amount. The amount of total purchase and VAT total, as per this book is entered as Total Purchase and VAT on Purchase in VAT Return.

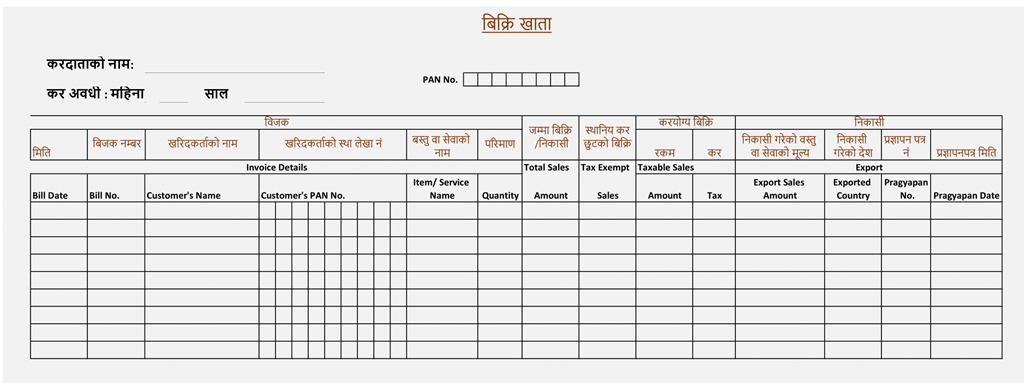

ii. Bikri Khata

This book maintains a detailed record of each sale made in a month. Sales should be classified as domestic sales, export, or sale of VAT exempted items. Businesses must record details of Sales returns & canceled Invoices. The total sales and VAT total, as per this book, are entered as Total Sales and VAT on Sales in VAT Return.

Business Entities who draw invoices electronically using software approved by IRD are not required to maintain Physical books of Kharid Khata and Bikri Khata if their software can generate reports of sales and purchases in the format just as physical Kharid Khata and Bikri Khata.

VAT Collection and Payment in Nepal

For Government, business entities are the ones liable to deposit VAT with Revenue Department. The tax period for every VAT registered entity is monthly unless the Revenue Department has granted permission to choose otherwise. This means a Business Entity needs to calculate the VAT Liability for a month and make payment within the 25th of next month. For example, VAT collected in the month of Shrawan is due for payment by the 25th of Bhadra.

Calculation of VAT Liability

VAT Liability is calculated using the basic formula below:

VAT Payable – VAT Output – VAT Input – VAT Credit brought forward from the previous period

Now let’s understand these terms one by one:

- VAT Output – VAT charged on Sales

For a business entity, when it makes a sale and draws an invoice on the customer, it charges VAT on the sales price made to the customer. Here, the selling price is recorded as the sales amount and VAT levied on the selling price is recorded as VAT Output in Bikri Khata. - VAT Input – VAT charged on Purchases

For a business entity, when it purchases any stock, fixed asset, or incurs any expense, it has to pay the purchase price of goods and services plus the VAT charged on the purchase price. Here, the purchase price is recorded as the purchase amount and VAT levied on the purchase price is recorded as VAT Input in Kharid Khata. - VAT Credit – VAT Input greater than VAT Output

VAT Liability is simply VAT on Sales minus VAT on purchases. So, only when Sales are made higher than the purchase, VAT Liability is generated. But there are times when Purchases made in a month are higher than the sales made in the month. In this case, the difference is negative and such a negative amount is termed VAT Credit. This credit can be utilized against the payment of VAT Liability calculated next month and can be carried forward until fully utilized.

| Scenario | Outcome | Liability |

| VAT on Sales > VAT on Purchase | VAT Payable | VAT Payable should be paid to Government by 25th of next month |

| VAT on Purchase > VAT on Sales | VAT Credit | Such VAT Credit can be utilized to set off VAT Payable in the coming months. This can be carried forward until it is fully utilized. |

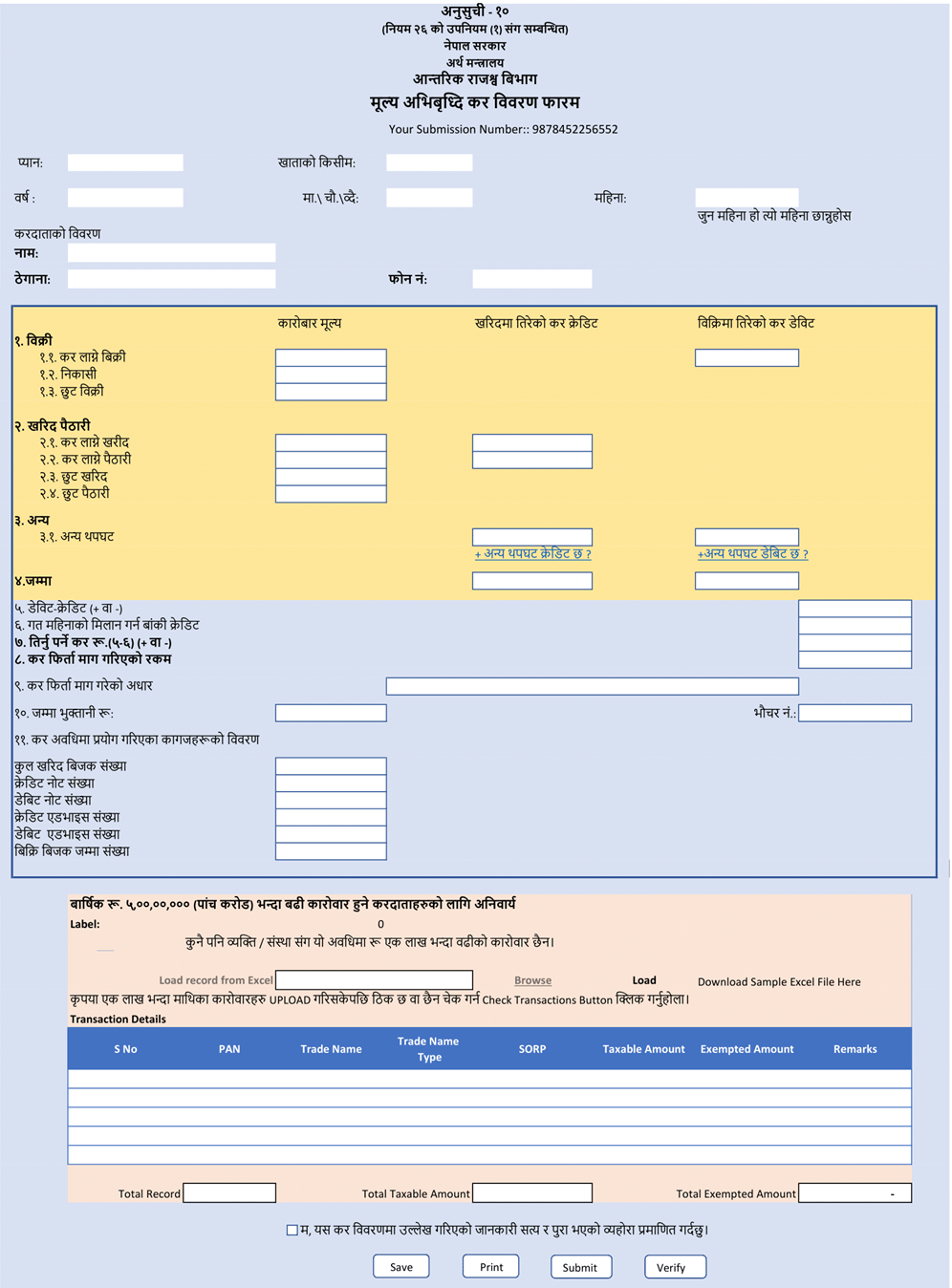

How to File VAT Return in Nepal?

VAT Return is basically an online form used to calculate VAT Liability for any month. We have to fill in details about:

- Net Sales amount and VAT Output

- Net Purchase amount and VAT Input

- VAT Adjustment

- VAT Credit Amount carried forward from the previous period

- Transaction details of sales and purchase exceed 1 lakh if the total turnover of the business cross 5 crores in the current or previous fiscal year.

There is no separate area to mention Purchase Return or Sales Return. These have to be adjusted with the gross purchase or sales amount. Sales Amount shall be the total sales as recorded in Bikri Khata. Similarly, Purchase Amount shall be the total purchase as recorded in Kharid Khata.

Inland Revenue Department Nepal: https://ird.gov.np

VAT Adjustment process in Nepal

VAT Adjustment provides us an opportunity to make revisions or adjustments for any incorrect calculation made, invoices left unreported, or any other transactions leading to incorrect VAT Calculation in the previous period.

5 skills that accountants need for preparation of VAT Return in Nepal:

1. Knowledge of VAT Act 2052:

Accountants need to have a good understanding of the Nepali VAT law in order to file accurate and timely returns. You should be able to identify taxable transactions, calculate the correct VAT amount, and file returns in the correct format.

For example, if a business sells goods or services to a customer in Nepal, the accountant will need to know whether the transaction is subject to VAT. If it is, the accountant will need to calculate the VAT amount by multiplying the sale price by the VAT rate.

2. Ability to use accounting software:

Accountants need to be able to use accounting software to track and record transactions, calculate VAT, and generate reports. They should be familiar with the different features and functions of accounting software, and be able to use it to efficiently complete their work.

3. Attention to Detail:

Accountants need to be very detail-oriented in order to file accurate returns. They should be able to carefully review transactions and documentation, and identify any potential errors.

4. Communication Skills:

Accountants need to be able to communicate effectively with clients, vendors, and government officials. They should be able to explain complex tax laws in a clear and concise way, and resolve any disputes that may arise.

5. Problem Solving Skills

Accountants need to be able to identify and solve problems related to VAT. They should be able to think critically and creatively, and come up with solutions that are both effective and efficient.

Accounting as a Career in Nepal:

- Keeping financial records

- Preparing financial statements

- Calculating taxes

- Assisting the Auditors during year-end

- Advising businesses on financial matters

Accountants need to be proficient in accounting software, such as Tally. They also need to be familiar with Nepali tax laws and regulations.

Learn Business Taxation and Learn Financial Reports Courses by Khata Business Academy

- Learn Business Taxation: This course covers the basics of Income Tax, VAT & TDS as per Nepali tax laws and regulations. You will learn how to calculate taxes, file tax returns, and comply with tax laws.

- Learn Financial Reports:This course covers the basics of financial statements preparations. You will learn how to prepare Transactional Reports, Taxation Reports, Financial Reports and Projection Reports.

Both courses are taught by experienced Chartered Accountants and are designed to help you gain the skills and knowledge you need to succeed in a career in accounting.