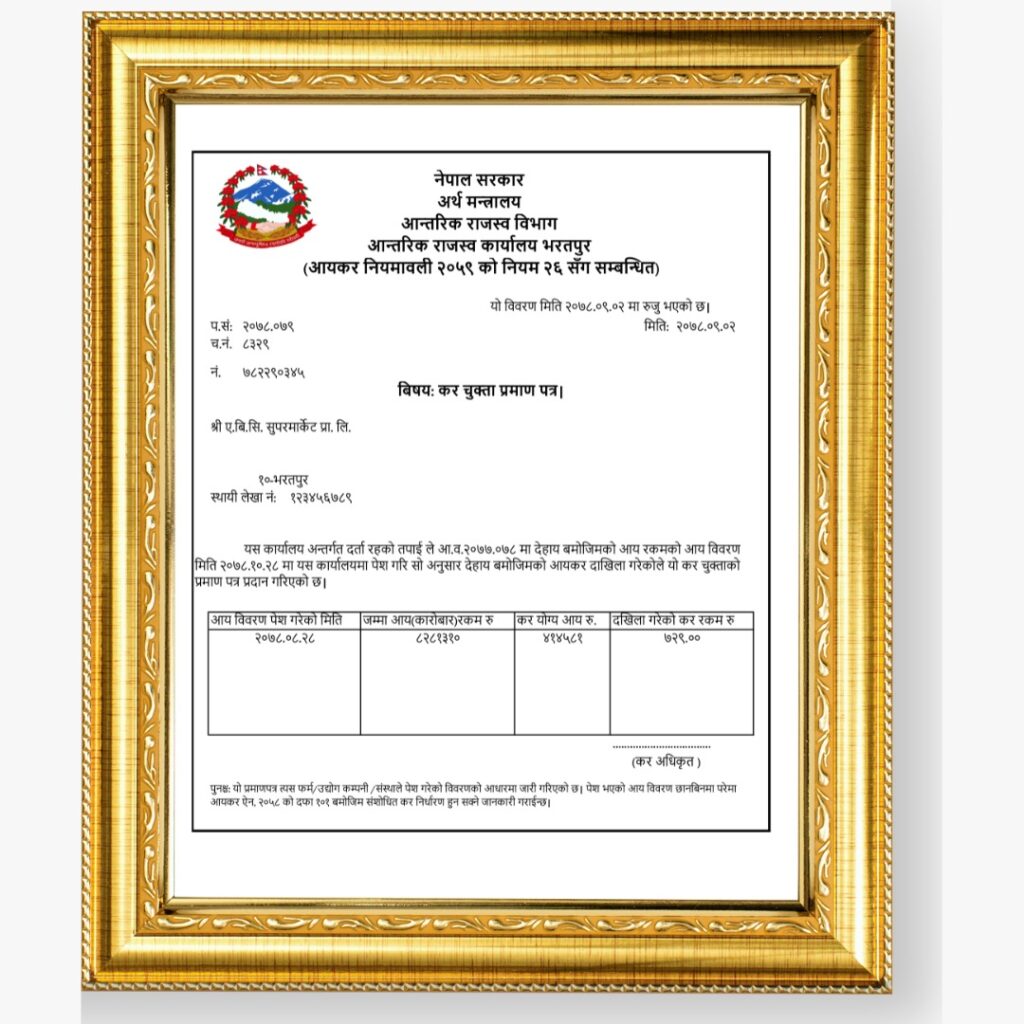

Poush Masanta, the most hectic time for an accountant, has passed, and most likely, the business you work for has already filed its tax returns. Now, it’s time to apply for the Tax Clearance Certificate (नेपालीमा कर चुक्ता प्रमाणपत्र)—a critical document that proves compliance with Nepal’s tax regulations.

So, what exactly is the Tax Clearance Certificate (कर चुक्ता प्रमाणपत्र) (TCC)?

A Tax Clearance Certificate (TCC) is an essential document that proves a person or business has fulfilled their tax obligations up to a specific date. Issued by the Inland Revenue Department (IRD) in Nepal, it serves as a legal proof of compliance with tax regulations. Whether you’re a business owner, self-employed professional, or an individual engaging in high-value transactions, understanding the process and importance of obtaining a TCC is crucial. This guide breaks down the concept in simple terms, making it easier for accountants and taxpayers to navigate the requirements.

The Fundamentals of Tax Clearance Certificate

A Tax Clearance Certificate is an official document that confirms there are no outstanding tax liabilities associated with a taxpayer. It assures the government and other stakeholders that the individual or entity is compliant with tax laws.

Who Needs a Tax Clearance Certificate?

Several groups are required to obtain a TCC in Nepal, including:

- Businesses and Companies: All registered businesses must obtain a TCC annually for legal compliance and to bid on government projects.

- Self-Employed Professionals: Doctors, lawyers, consultants, and other professionals may need a TCC to renew their professional licenses.

- Non-Governmental Organizations (NGOs): Both NGOs and INGOs need TCCs to renew their registration and for fund management.

- Government Contractors: Contractors and suppliers bidding for government projects must present a TCC.

- Foreign Investors: Foreign companies and investors operating in Nepal must secure a TCC to ensure compliance with local tax laws.

Why Is a Tax Clearance Certificate Important?

- Legal Compliance: It proves that the taxpayer has adhered to tax laws, ensuring no penalties or legal consequences.

- Financial Credibility: A TCC enhances the credibility of a business or individual, especially when dealing with banks, investors, or government authorities.

- Smooth Transactions: This is a mandatory document for several financial and legal transactions, such as obtaining loans, selling assets, or bidding on projects.

- Avoiding Penalties: Failing to obtain a TCC may result in fines, legal action, or restrictions on business operations.

Documents Required for Tax Clearance

To apply for a Tax Clearance Certificate, ensure you have the following documents ready:

- Completed Application Form: This can be obtained online or from your local tax office.

- Permanent Account Number (PAN) Card: Proof of your tax registration.

- Audited Financial Statements: For businesses, this includes balance sheets and profit & loss accounts for the relevant fiscal year.

- Tax Returns (D-01, D-02, or D-03): Copies of filed tax returns for the Financial Year.

- Proof of Tax Payments: Receipts or bank statements showing all tax dues (Income Tax, TDS Payables and VAT) have been paid.

- Tax Deduction at Source (TDS) Certificates: If applicable, ensure all TDS amounts are accounted for.

- VAT Returns up to the month of Mangsir: For businesses registered for VAT.

How to Apply for a Tax Clearance Certificate

- Visit your local tax office and request the application form.

- Fill out the form carefully with accurate details.

- Attach all necessary documents.

- Submit the form to the tax office and retain the receipt for follow-up.

After submission, the tax office will review your application. Ensure that:

- All tax returns are filed.

- Tax payments are updated.

- Documents are complete and accurate.

If any discrepancies are found, you may be asked to provide additional information or documents.

Note: The above-mentioned process is for D-03 Tax Return Filers only. D-01 and D-02 Tax Filers can also apply for Tax Clearance Certificate online from the IRD website.

What can cause a problem?

- Unfiled Tax Returns: Overlooking tax filing deadlines can delay the TCC process. Ensure all past returns (Also for ETDS and VAT Returns) are submitted.

- Disputes with Tax Authorities: Tax disputes can cause delays. Please try to resolve them promptly by providing accurate data.

- Incomplete Documentation: Missing or incorrect documents can lead to rejection. Double-check all requirements.

- Technical Issues: Online applications may face technical glitches. Contact support for assistance if needed.

How Accountants Can Add Value

Accountants play a critical role in helping clients obtain a TCC efficiently. Here’s how:

- Proactive Compliance Management:

- Keep clients informed about tax deadlines and obligations.

- Implement systems to track tax filings and payments.

- Document Preparation:

- Ensure all financial records are accurate and complete.

- Organize and submit the required documents on behalf of your business.

Let’s sum it all up.

Obtaining a Tax Clearance Certificate is an essential process for businesses and professionals in Nepal. It demonstrates compliance with tax laws, enhances credibility, and facilitates smooth financial transactions. By understanding the requirements and following the application steps, taxpayers can avoid delays and penalties.

For accountants, assisting your business with the TCC process is a valuable skill that ensures long-term responsibilities and builds trust. With the right preparation and guidance, obtaining a Tax Clearance Certificate can be a hassle-free experience.

Good Luck!