Every business in Nepal is required to file an Income Tax Return for Finance Year 2079-80 by Asoj 30th, 2080. Private firms in Nepal can file one of the three tax returns, D1, D2, or D3 whereas if your business is a Private Limited Company, you must file D3 Tax Return compulsorily. We understand Accountants have a lot of responsibilities during the tax season. You must prepare, review, and submit accurate financial information to ensure compliance with tax laws and make adequate payments of tax liabilities before the due date to avoid any fines or penalties.

As the due date of Income Tax Return is approaching, let’s dive into 5 major roles an accountant needs to perform:

1. Ensure Proper Documentation and Reporting

One of the first and most crucial steps during tax season is ensuring proper documentation and reporting. Accountants must gather all financial documents, such as income statements, receipts, invoices, and expense records. This process sets the foundation for accurate income tax filings. It’s essential to maintain organized records to support the numbers reported in tax returns and to facilitate external audits.

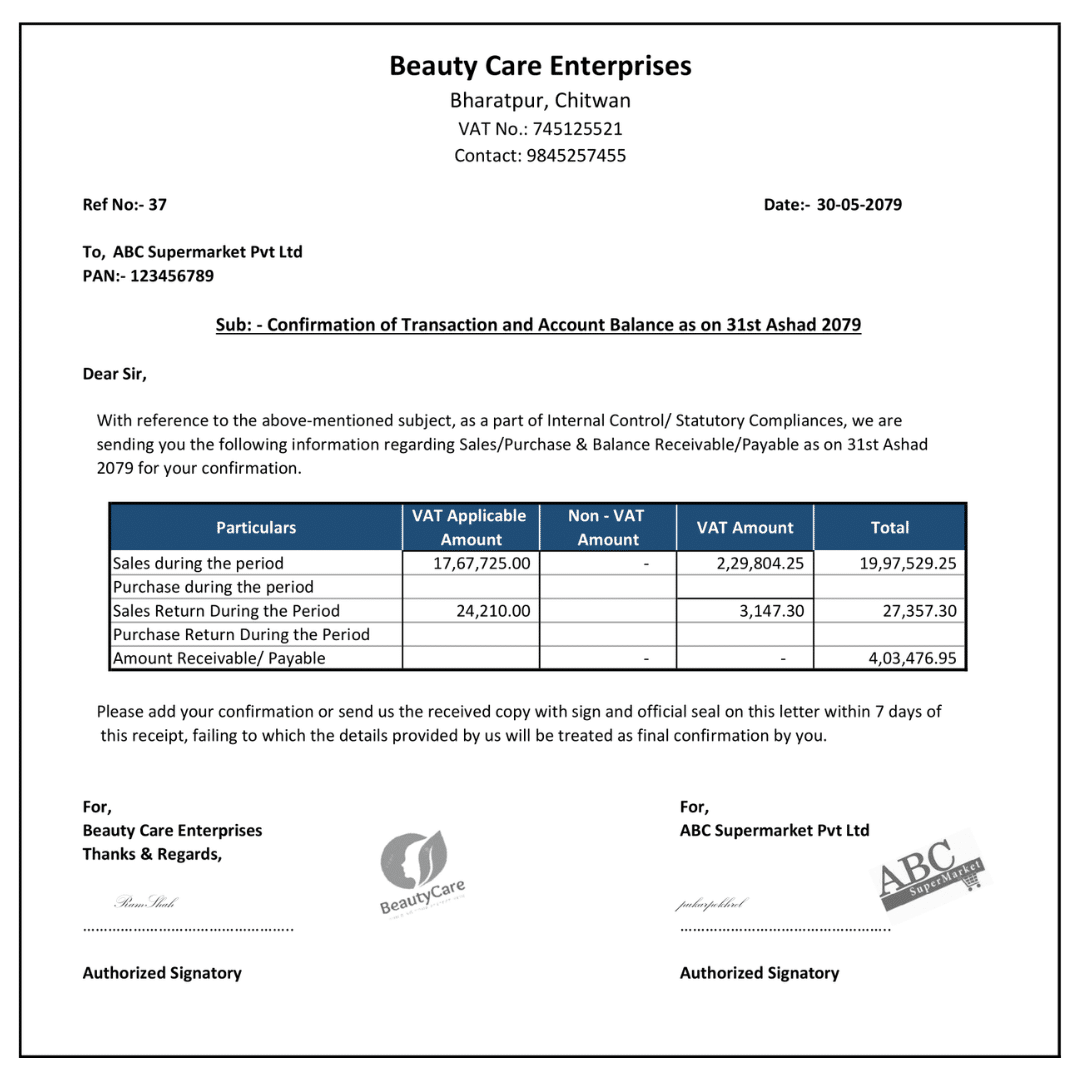

2. Confirm Balance of Debtors & Creditors

Accountants carefully review the balance of debtors (money owed to the business) and creditors (money the business owes to others) before finalizing and filing financials and tax returns. Confirming the party balance is very important because if any of the following: Opening, Purchase, Sales, or Closing is more than Rs 1,00,000 during FY 2079-80 you need to show the amount in Annexure 13 while filing the tax return. Any mismatch in Annexure-13 can lead to the scrutiny by Income Tax Office.

Sample of Confirmation Letter From Beauty Care Enterprises to ABC Supermarket Pvt.Ltd.

3. Finalize Financial Statements (Balance Sheet, Profit & Loss, etc.)

Preparing financial statements is a pivotal task for accountants during tax season. You need to create financial statements like the balance sheet, profit and loss statement (income statement), and cash flow statement. These documents provide a comprehensive snapshot of a business’s financial position and performance. You need to make adjustment entries like depreciation, accruals, and deferred items while finalizing the financials. Please note that continuous communication with internal and external auditors is advised while finalizing.

You can access Accountants Guide to Preparation of Balance Sheet from this link: https://khataacademy.com/np/blogs/accounting/preparation-of-balance-sheet/

You can access Accountants Guide to Preparation of Profit and Loss from this link: https://khataacademy.com/np/blogs/accounting/profit-and-loss-statement/

4. Communicate with External (Statutory) Auditor

Every D3 Income Tax Return filer needs to Audit their Financial Statements compulsorily before filing Income Tax Returns. In every business, especially medium to larger corporations, statutory auditors are thoroughly involved in the tax preparation process. Accountants need to collaborate closely with external auditors to ensure that financial information is accurately presented, and internal controls are functioning effectively. This collaboration helps in validating the accuracy of financial statements and enhances transparency.

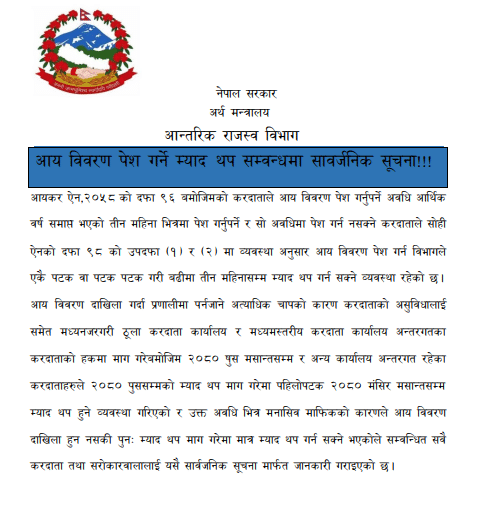

5. File 2-3 Months Extention (If required, with proper reasons)

If for any reason you are unable to file your Income Tax Return within Asoj 30th, you can file an extension with IRD with adequate reasons. If your business falls under Large or Medium Tax Office, you can file an extension of 3 months, i.e. up to Poush end, and for other businesses, you can file an extension for 2 months, i.e. up to Mangsir end in the first phase and for further 1 month upto Poush end if you have valid reasons in the second phase.

Notice From IRD Regarding Return Date Extension.

Process to File Tax Extension:

Step 1. Visit https://ird.gov.np/

Step 2. Go to General > Taxpayer Login

Step 3. Enter your PAN & Password

Step 4. Click on “Request For Filing Date Extension”

Step 5. Enter Finance Year as 2079-80, Extension Date and Reason

Step 6. Click “Save” or “Submit”

In conclusion, the role of accountants during tax season is multifaceted and vital. You need to work diligently to ensure proper documentation, accurate reporting, and compliance with tax laws. By confirming balances, finalizing financial statements, communicating with external auditors, and, when necessary, filing for extensions, accountants play a critical part in making tax season a smoother and more efficient process for your business.

How to Learn Advanced Accounting Skills from Khata Business Academy:

Khata Business Academy offers three interactive online courses that can help you learn and prepare Tax Returns, Financial Reports including Balance Sheet, Profit & Loss, Cash Flow and Financial Projections:

Business Taxation Course

You can learn Income Tax Computation and VAT & TDS Return Filing process along with in-depth concepts and case studies. You can also practice with live templates and calculate Fines as well as Penalties. Recommended for Fresher to Experienced Accountants.

You can access the course through this link: https://khataacademy.com/np/courses/business-taxation-course/

Financial Reporting Course

This course covers the basics of financial statement preparations. You will learn how to prepare Transactional Reports, Taxation Reports, Financial Reports, and Projection Reports. Recommended for accountants with 1-3 years of experience.

You can access the course through this link: https://khataacademy.com/np/courses/financial-reporting-course/

NFRS Based Accounting

This course covers the concepts, implementation, and reporting framework under Nepal Financial Reporting Standard (NFRS) based on IFRS. NFRS is being implemented in Nepal from FY 2080-81 onwards. Recommended for Account Managers.

You can access the course through this link: https://khataacademy.com/np/courses/nfrs-for-accountants/

You can access the course through this link: https://khataacademy.com/np/courses/nfrs-for-accountants/

All of these courses are taught by experienced Chartered Accountants and are designed to help you gain the skills and knowledge you need to succeed in a career in accounting. Come, join the KBA Family of Accountants.