Introduction of Cash Flow Statement

A cash flow statement is a financial statement that shows the movement of cash and cash equivalents in and out of a business during a specific period of time. It tells how much cash the company can use for its operations, investments, and financing activities. It’s like tracking all the money the business gets and spends. A cash flow statement might have a few different names, like CSF, statement of cash flow, SCF, or consolidated statement of cash flows. But no matter the name, they all mean the same thing: it’s like a special money report for a company.

For example: it can show if the company is borrowing too much money to keep running its business, but it’s not making enough money to easily pay back those loans. This helps us understand how the company is doing with its money.

Why do we need Cash Flow Statements?

We need a cash flow statement because it helps us to understand how a business manages its cash resources, generates cash from its operations, invests in its growth, and meets its financial obligations.

- It shows the liquidity of a business, meaning how much cash is available to pay for its expenses and debts.

- It shows the sources and uses of cash in a business, such as operating activities, investing activities, and financing activities.

- It shows the changes in cash and cash equivalents over a period of time, such as a month, quarter, or year.

- It shows the difference between the income and the cash flow of a business, which may not be the same due to accrual accounting.

- It shows the investment decisions of a business, such as buying or selling long-term assets, which affect its future growth and returns.

- It shows the financing decisions of a business, such as borrowing or repaying loans, issuing or buying back shares, paying dividends, etc., which affect its capital structure and cost of capital.

Negative and Positive Cash Flow

Negative cash flow and positive cash flow are two terms that describe the net amount of cash and cash equivalents that a business receives or spends in a given period of time.

Negative Cash Flow: Negative cash flow means that a business spends more cash than it receives. This can happen when a business has high operating costs, low sales, large investments, or high debt payments. Negative cash flow can indicate that a business is facing financial difficulties or liquidity problems and may not be able to pay its bills or debts on time.

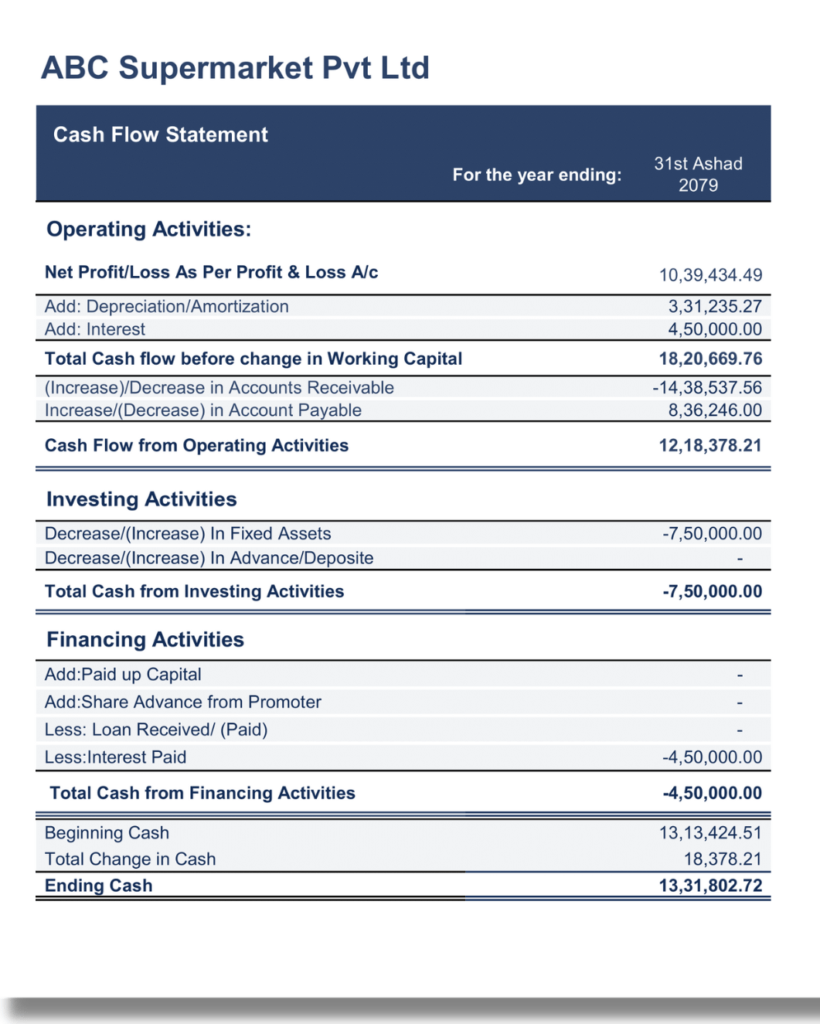

Example of Cash Flow Statement

From this CFS, we can see that the net cash flow for the 2079 fiscal year ending cash was Rs 13,31,802.72. The total cash flow before change in working capital is Rs 18,20,669.76 where the Cash Flow from Operating Activities was 12,18,378.21, total cash from investing activities was Rs (7,50,000) and at last the total cash from financing activities was Rs (450,000).

Where do Cash Flow Statement come from?

Statement of Cash Flow using the direct and indirect methods

A statement of cash flow using the direct and indirect methods is a financial statement that shows how a business generates and spends cash in a given period of time using different approaches.

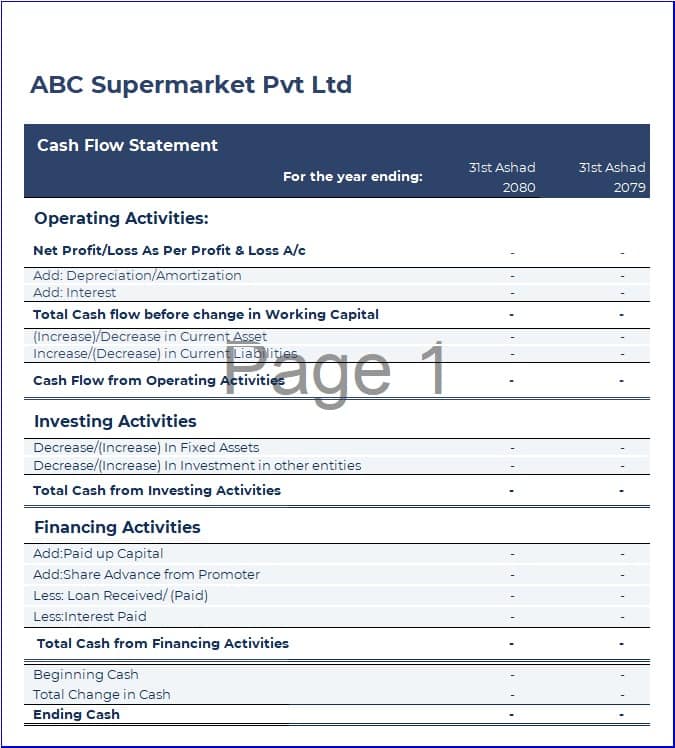

Free Cashflow Template for Accountants

Fill-up the required details below to download the Cashflow Template.

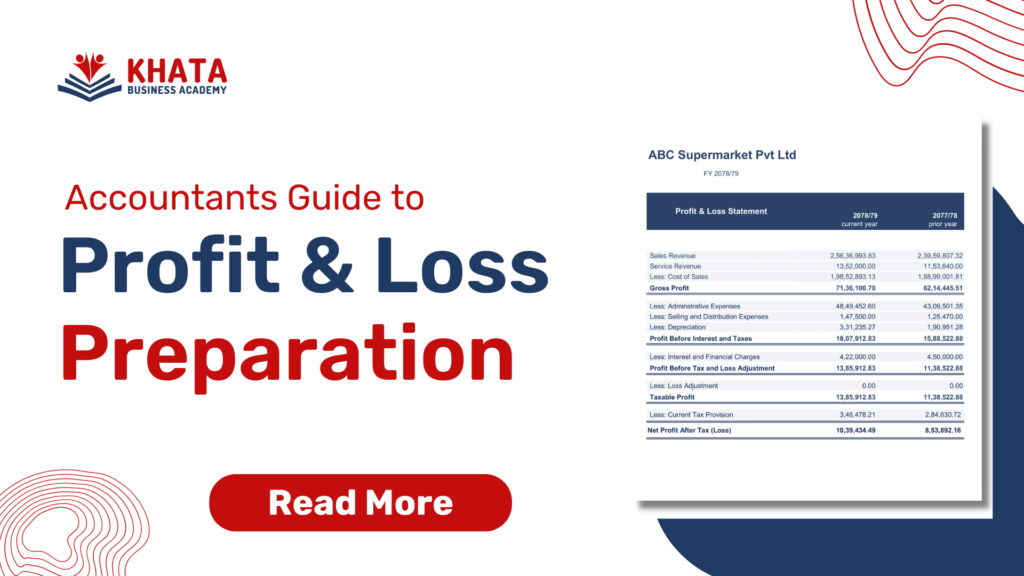

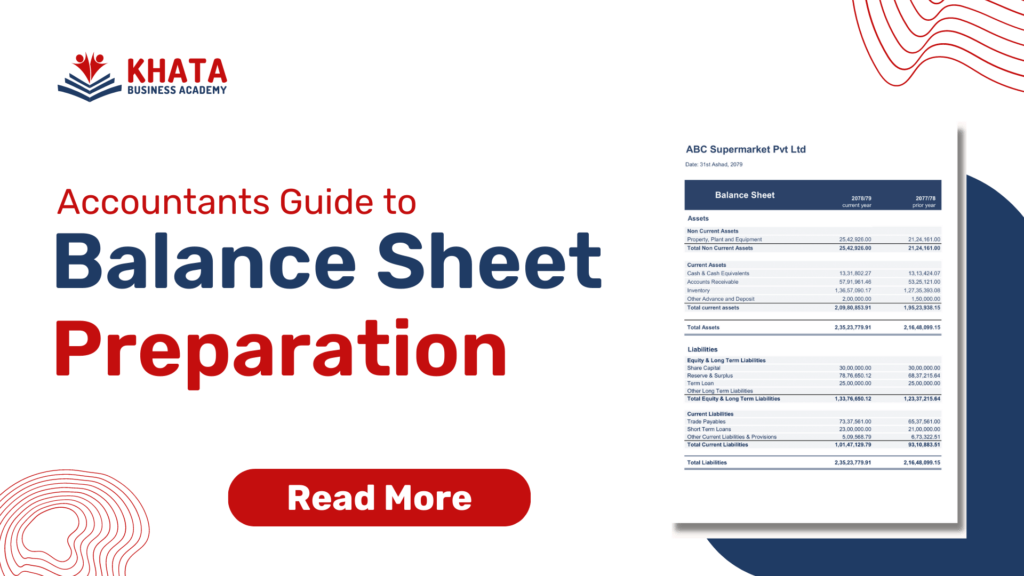

More on Financial Reporting

How to Learn Cash Flow Statement from Khata Business Academy

- Learn Financial Reports: This course covers the basics of financial statements preparations. You will learn how to prepare Transactional Reports, Taxation Reports, Financial Reports and Projection Reports. Recommended for accountants with 1-3 years of experience.

- Learn NFRS For Accountants: This course covers the concepts, implementation and reporting framework under Nepal Financial Reporting Standard (NFRS) based on IFRS. NFRS is being implemented in Nepal from FY 2080-81 onwards. Recommended for account managers.