What is NFRS?

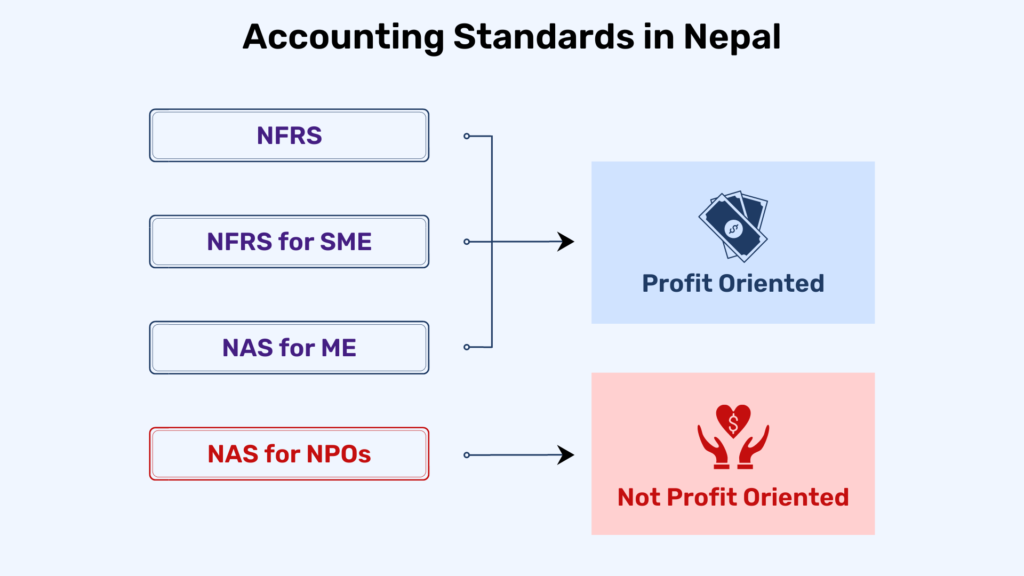

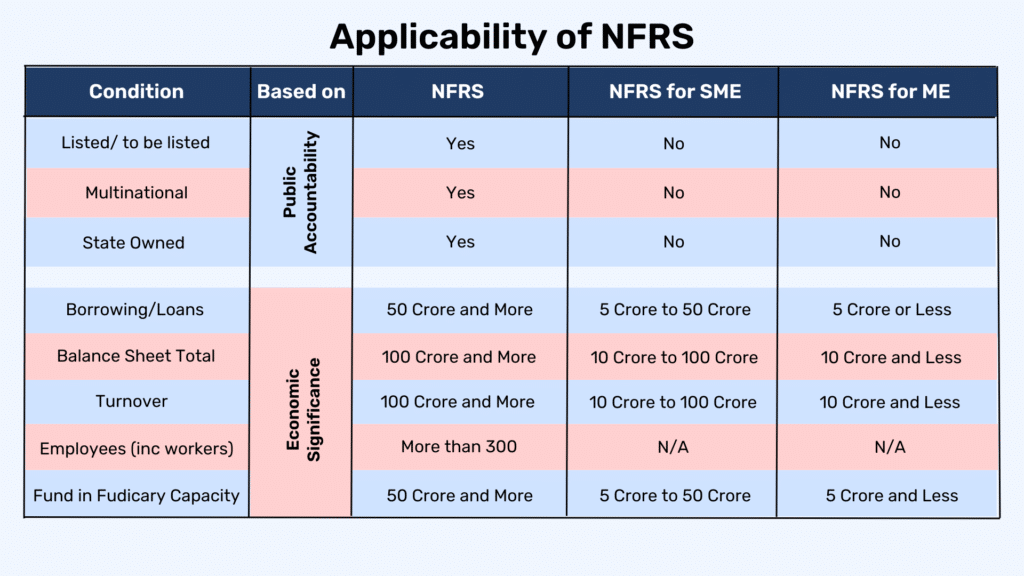

Nepal Financial Reporting Standards (NFRS) are a set of accounting rules that are to be used by businesses in Nepal to make their financial statements consistent, transparent, and easy to compare. They were developed by the Accounting Standards Board (ASB) in 2013 to ensure global consistency in financial reporting and help investors make informed decisions. NFRS is in line with IFRS which stands for International Financial Reporting Standard.

IFRS is used in over 100 countries, including the European Union and many G20 countries. It replaced older standards called International Accounting Standards (IAS) in 2001. IFRS is essential for those working in accounting and provides opportunities to work with multinational companies or move abroad. It is becoming increasingly adopted by countries to achieve uniform reporting.

Why NFRS is important for Accountants?

NFRS is like a global accounting rule that many countries and the world economy consider very important. Here’s why it matters:

- NFRS promotes honesty and accountability in financial statements, reducing errors and preventing manipulation of funds, transactions, and balances.

- NFRS ensures uniform and understandable presentation of financial statements, allowing for easy comparison of company growth on a global level.

- NFRS helps track transactions, record fund information, and ensures secure foreign investments, especially for significant assets and transactions.

- NFRS strengthens accountability by closing gaps in inadequate financial reporting and may impose penalties for non-compliance.

- NFRS simplifies mergers and acquisitions, especially across borders.

Since many countries around the world has already been reporting as per the global standard, i.e. IFRS, businesses in Nepal also need a standard which is in line with IFRS. Hence, NFRS was introduced by ICAN through ASB.

Summary of different NFRS / NAS:

NFRS 1: First-time Adoption of International Financial Reporting Standards

NFRS 1 provides guidelines for companies adopting it for the first time. It provides criteria, structure and framework necessary for conversion for GAAP to NFRS.

NFRS 2: Share-Based Payment

NFRS 2 makes companies include share-based payments (like shares, options, or rights) in their financial statements. It covers transactions settled in cash or company shares, with specific guidelines for each.

NFRS 3: Business Combinations

NFRS 3 outlines how to account for business combinations (like mergers or acquisitions) using the ‘acquisition method.’ It measures assets and liabilities at fair values on the acquisition date. The main benefit is that it allows easy comparison of different companies because they present data on the same basis.

NFRS 4: Insurance Contracts

NFRS 4 applies to all insurance contracts issued by a company, including reinsurance contracts.

NFRS 5: Non-current Assets Held for Sale and Discontinued Operations

NFRS 5 guides how to account for assets that a company plans to sell or distribute to owners. These assets are not depreciated, measured at the lower of carrying amount or fair value minus selling costs, and shown separately in the financial statements. Specific disclosures are required for discontinued operations and asset disposals.

NFRS 6: Exploration for and Evaluation of Mineral Resources

NFRS 6 lets companies keep using their old accounting policies for exploration and evaluation assets when they adopt the standard for the first time. It also changes how companies test for impairment of these assets by introducing new indicators and allowing testing at a combined level.

NFRS 7: Financial Instruments: Disclosures

NFRS 7 requires companies to disclose the importance of financial instruments and the risks they pose. They must provide both qualitative and quantitative information. Specific details are needed for transferred financial assets and other related matters.

NFRS 8: Operating Segments

NFRS 8 requires certain companies to disclose information about their business segments, products, services, geographic areas, and major customers. They use internal management reports to identify and measure this information.

NFRS 9: Financial Instruments

NFRS 9 tells us how to recognize and measure financial instruments, deal with impairment, recognition, and general hedge accounting.

NFRS 10: Consolidated Financial Statements

NFRS 10 guides how to prepare consolidated financial statements. Companies must consolidate entities they control, meaning they have power to influence profits and affect returns.

NFRS 11: Joint Arrangements

NFRS 11 explains accounting for arrangements jointly controlled by multiple companies. Joint control means sharing control. The arrangements are classified as joint ventures (sharing net assets) or joint operations (having rights and obligations).

NFRS 12: Disclosure of Interests in Other Entities

NFRS 12 requires companies to share details about their interests in subsidiaries, joint arrangements, associates, and unconsolidated ‘structured entities’.

NFRS 15: Revenue from Contract

The most important standard; NFRS 15 explains how and when a company following NFRS will record revenue and requires them to give more useful information in their financial statements. The rule uses a simple five-step model that applies to all contracts with customers.

NFRS 16: Lease Accounting

NFRS 16 explains how companies using NFRS should handle leases. It requires lessees to recognize assets and liabilities for most leases, while lessors continue classifying leases as operating or finance.

NAS 1: Presentation of Financial Statements

NAS 1 provides rules for organizing financial statements, including their structure, guidelines, and the necessary information they must contain. It requires presenting a full set of financial statements every year and including the amounts from the previous year.

NAS 7: Cash Flow Statement

NAS 7 explains how to show data in a cash flow statement. It tells us about the company’s cash and cash equivalents and how they are changed bifurcating them into operational, investment and financial categories.

NAS 8: The Accounting Policies, Changes in Accounting Estimates and Errors

NAS 8 provides guidelines for selecting and changing accounting policies, handling changes in accounting estimates, disclosing policy changes, and correcting errors.

NAS 10: Events after the Reporting Period

NAS 10 tells companies when they should adjust their financial statements for events that occur after the reporting period. It also guides companies on disclosing information about when the financial statements were authorized for issue and events that happened after the reporting period.

NAS 12: Income Taxes

NAS 12 guides how companies should handle income taxes based on taxable profits. It requires recognizing deferred tax liabilities or assets for temporary differences, with a few exceptions.

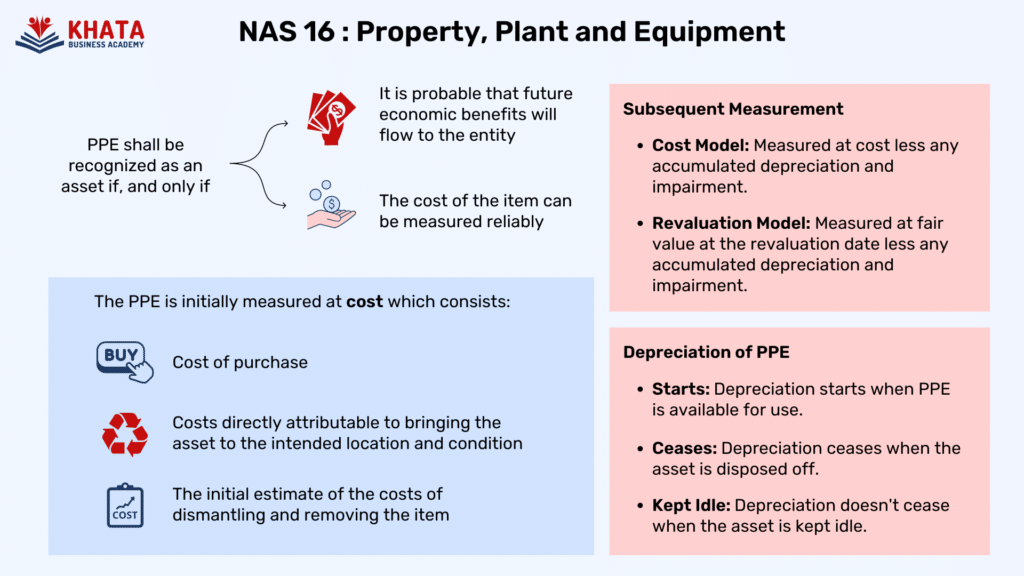

NAS 16: Property, Plant, and Equipment

NAS 16 sets rules for companies to recognize property, plant, and equipment as assets. It also explains how to measure their carrying amounts, calculate depreciation charges, and handle impairment losses.

NAS 17: Leases

NAS 17 categorizes leases into two types: finance lease and operating lease. A finance lease is when the contract transfers most risks and rewards, making it similar to ownership. An operating lease is when the lease doesn’t transfer most risks and rewards, also resembling ownership.

NAS 19: Employee Benefits

NAS 19 deals with all types of employee benefits except for share-based payments, which are covered by NFRS 2. NAS 19 requires companies to recognize a contract when an employee provides service for future benefits.

NAS 20: Accounting for Government grants and the Disclosure of Government Assistance

NAS 20 is about government grants. These are resources given to a company by the government, either for past agreements or future ones, with certain conditions related to the company’s operations.

NAS 21: Effects of the Changes in Foreign Exchange Rates

NAS 21 guides companies on dealing with foreign activities in two ways. It covers transactions using foreign currencies and international business operations.

NAS 23: Borrowing Costs

NAS 23 explains how companies should measure borrowing costs, especially the costs of acquiring, constructing, or producing assets funded by the company’s general borrowings.

Accountants Guide to Prepare Financials for the First Time

Step 1: Recognize assets and Liabilities.

- Property Plant and Equipment’s as per NAS 16

- Biological Assets as per NAS 41

- Inventories as per NAS 2

- Non-current Asset held for sale as per NFRS 5

- Investment property as per NAS 40

- Deferred Tax Asset and Liabilities as per NAS 12

- Provision as per NAS 37

- Liabilities related to Employee benefits as per NAS 19

Step 2: Derecognize assets and Liabilities.

Accountants need to derecognize certain assets and liabilities that have been included in Financial Statements which are not permitted as per NFRS.

Step 3: Reclassify assets and Liabilities as per NFRS Standards

Certain group of assets and liabilities need to be reclassified if they were classified previously as per GAAP and needs a different classification as per NFRS.

Step 4: Measure assets and Liabilities as per NFRS Standard

Finally, it’s time to prepare and report everything as per NFRS. Accountants are advised to understand every standards in detail before start preparing financial reports.

Why to choose NFRS for Accountants by KBA?

Khata Business Academy understands that there is a huge requirement for Accountants to learn NFRS Based Skills. Hence, we have developed an interactive course “NFRS For Accountants” which is delivered by CA Bishal Bhattarai.

You need to attend live sessions, watch video guides and practice with multiple templates in order to obtain maximum benefits from this course. Learn advanced analytical skills using NFRS and become an Accountant that business trusts.

How can you learn NFRS with KBA?

We use 4 different methods and resources:

- We use Interactive Live Session for your effective learning.

- We use Conceptual Videos for your topic-wise clarity.

- We use E-Books for your quick reference.

- We use Practice Templates for complete hands-on experience.