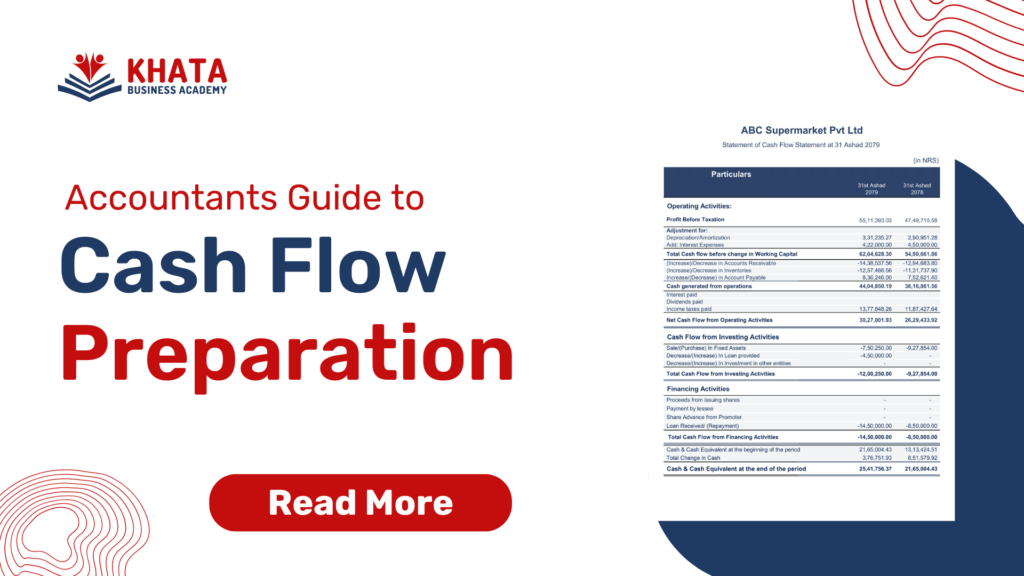

Accountants Guide to Preparation of Cash Flow Statement

Introduction of Cash Flow Statement A cash flow statement is a financial statement that shows the movement of cash and cash equivalents in and out of a business during a specific period of time. It tells how much cash the company can use for its operations, investments, and financing activities. It’s like tracking all the […]

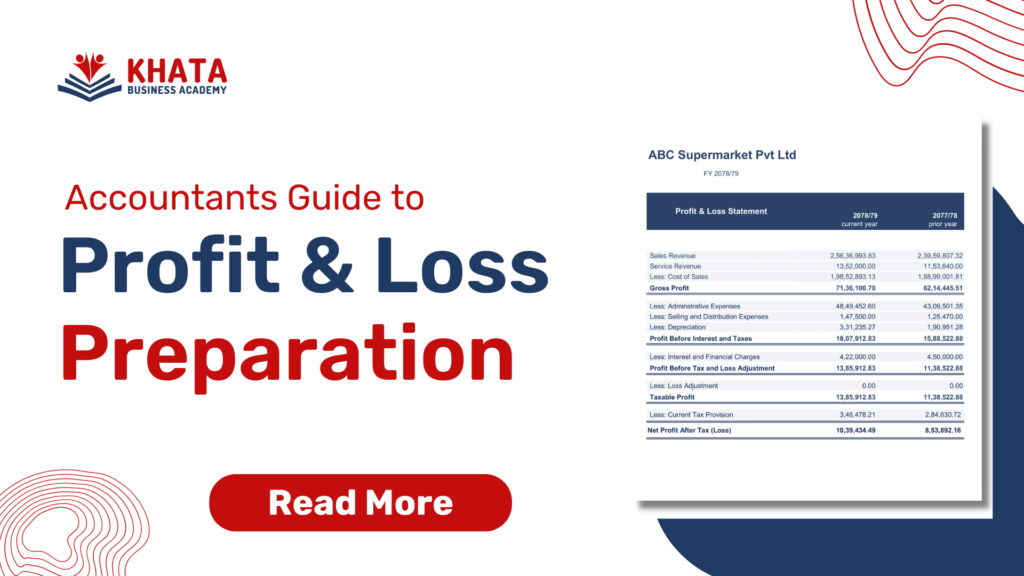

Accountants Guide to Preparation of Profit and Loss Statement

More Info on Financial Reporting Course Introduction to Profit and Loss Statement A Profit and Loss (P&L) statement is a money report that shows how much a company earned and spent during a certain time, like a few months or a year. It tells if the company made more money than it spent (profit) or […]

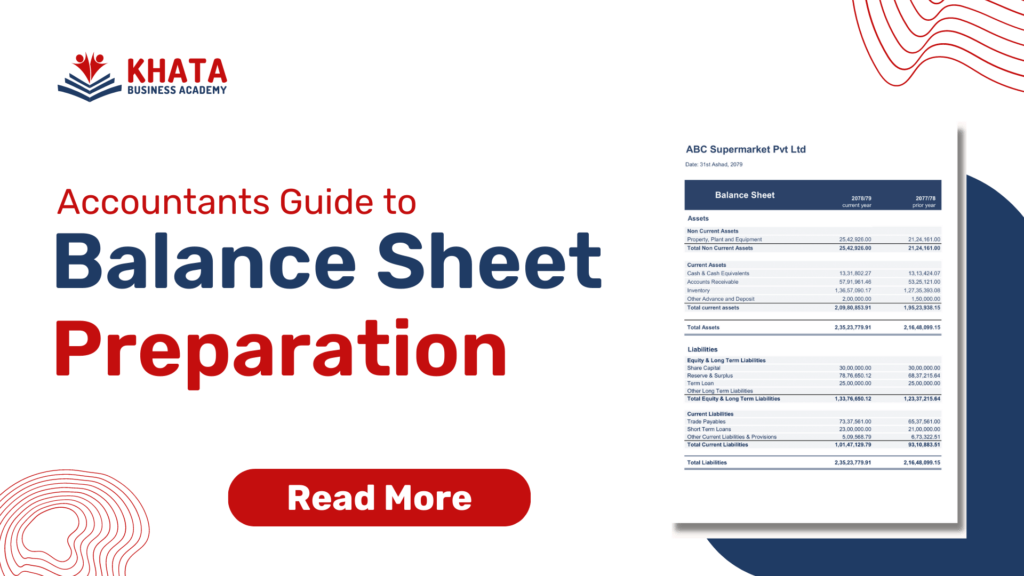

Accountants Guide to Preparation of Balance Sheet

Introduction to Balance Sheet A balance sheet is a financial statement that shows the financial position of a company at a given point in time. It records the assets and liabilities of the business at the end of the accounting period after the preparation of trading and profit and loss accounts. The balance sheet is divided […]

Accountant’s Guide to NFRS Implementation

What is NFRS? Nepal Financial Reporting Standards (NFRS) are a set of accounting rules that are to be used by businesses in Nepal to make their financial statements consistent, transparent, and easy to compare. They were developed by the Accounting Standards Board (ASB) in 2013 to ensure global consistency in financial reporting and help investors […]

Excel club for Accountants

Every accountant has a best friend. Any guesses who that might be? Yes, it is MS Excel. Accountants rely on Excel to perform most of their functions, from data management to reporting to reconciliations. The days of Manual Accounting is over now. Today most of the businesses use accounting software to manage their books. But learning […]

FY 2079-80 Closing: 20 Tasks Accountants Must Learn

The financial year 2079-80 is almost over. Before closing their books and start for next financial year, accountants should take care of multiple items in their financials. It covers dealing with adjustment entries, changes in software, computation and payment Advance Tax, VAT, TDS and many other items. Year-end closing is often the busiest time for […]

Free Cash Book Template For Accountants

A cash book is a document that records all the money that comes in and goes out of a business. It is like a diary of your business’s cash flow.

The cash book is divided into two columns: Input and Output.

VAT Return Filing in Nepal: 5 Key Skills For Accountants

We are here to talk to you about VAT, or value-added tax. VAT is a consumption tax that is levied on the value added to goods and services at each stage of production and distribution. In Nepal, VAT is administered by the Inland Revenue Department (IRD) as per Value Added Tax Act, 2052.

NFRS for Accountants

Accounts Manager who wants to develop Advanced Analytical Financial Skills using NFRS.

Excel Course for Accountants

Master Excel and streamline your accounting tasks! Our course offers practical and relevant techniques that are guaranteed to save you time. Join now and become an Excel-savvy accountant!