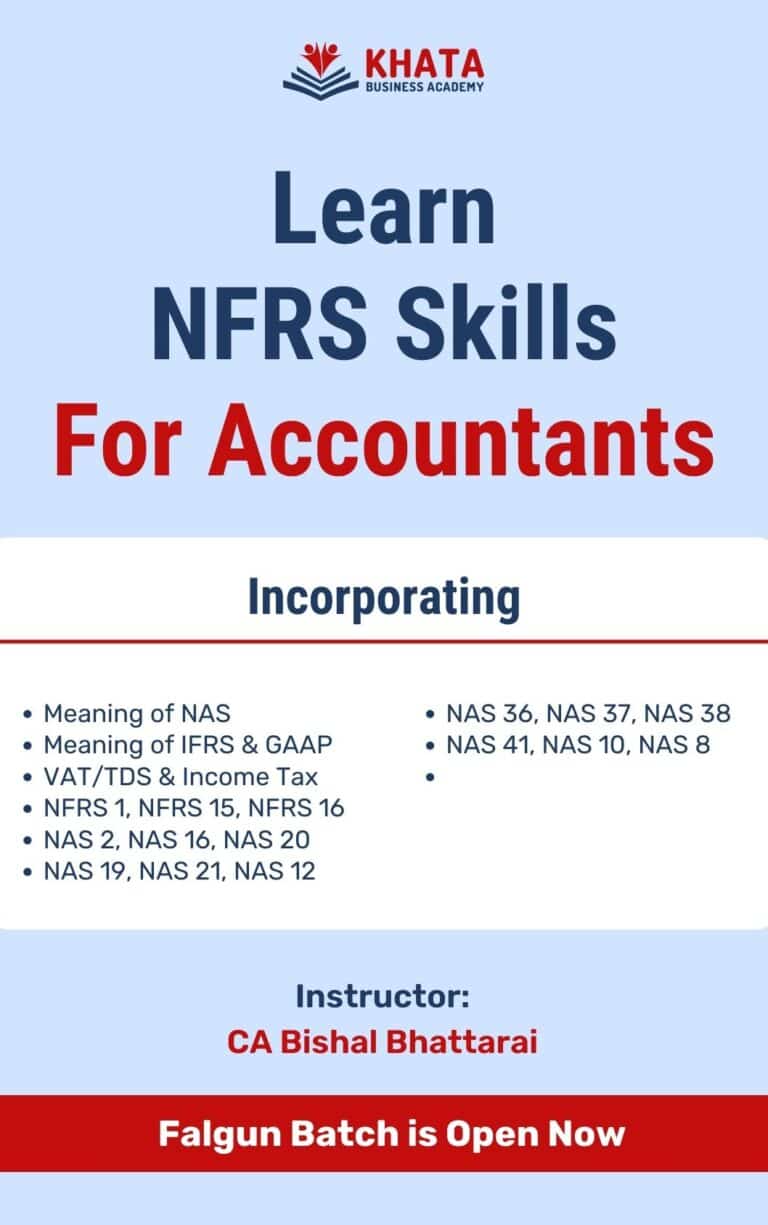

Course Contents:

1. Basic Introduction

-

Meaning of Nepal Accounting Standard [NAS]

-

Transition from NAS to NFRS

-

Meaning of IFRS & GAAP

-

Concepts of VAT/TDS & Income Tax

2. First time implementation of NFRS

-

NFRS 1 – First time adoption of Nepal

-

Objective

3. Understanding NFRS/ NAS & its impact on Financial Statement

-

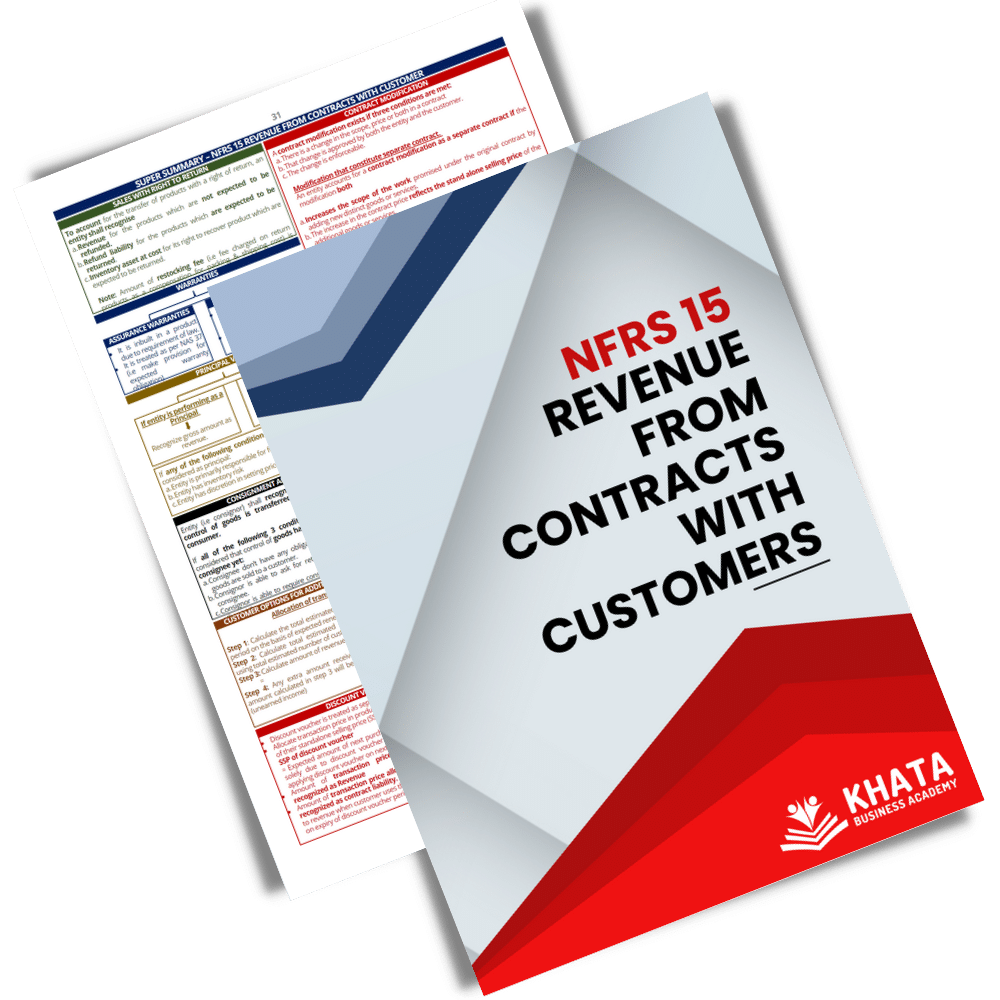

NFRS 15: Revenue from contracts with customers

-

NAS 2: Inventories

-

NAS 23: Borrowing Costs

-

NAS 16: Property, plant and equipment

-

NAS 19: Employee Benefits

-

NAS 20: Accounting for govt. grants & disclosure of govt. assistance

-

NAS 21: The effect of change in Foreign exchange rates

-

NAS 12: Income taxes

-

NAS 36: Impairment of assets

-

NAS 37: Provisions, Contingent Liabilities & Contingent Assets

-

NAS 38: Intangible Assets

-

NFRS 16: Leases

-

NAS 41: Agriculture

-

NAS 10: Events after the reporting period

-

NAS 8: Accounting Policies, changes in accounting estimates & errors

-

NAS 7: Statement of Cashflow

4. Financial statement, Significant accounting policies & Notes to Account as per NFRS

-

NAS 1: Presentation of Financial Statements

-

Significant accounting policies

-

Notes to account including different disclosure as per various NAS/ NFRS.