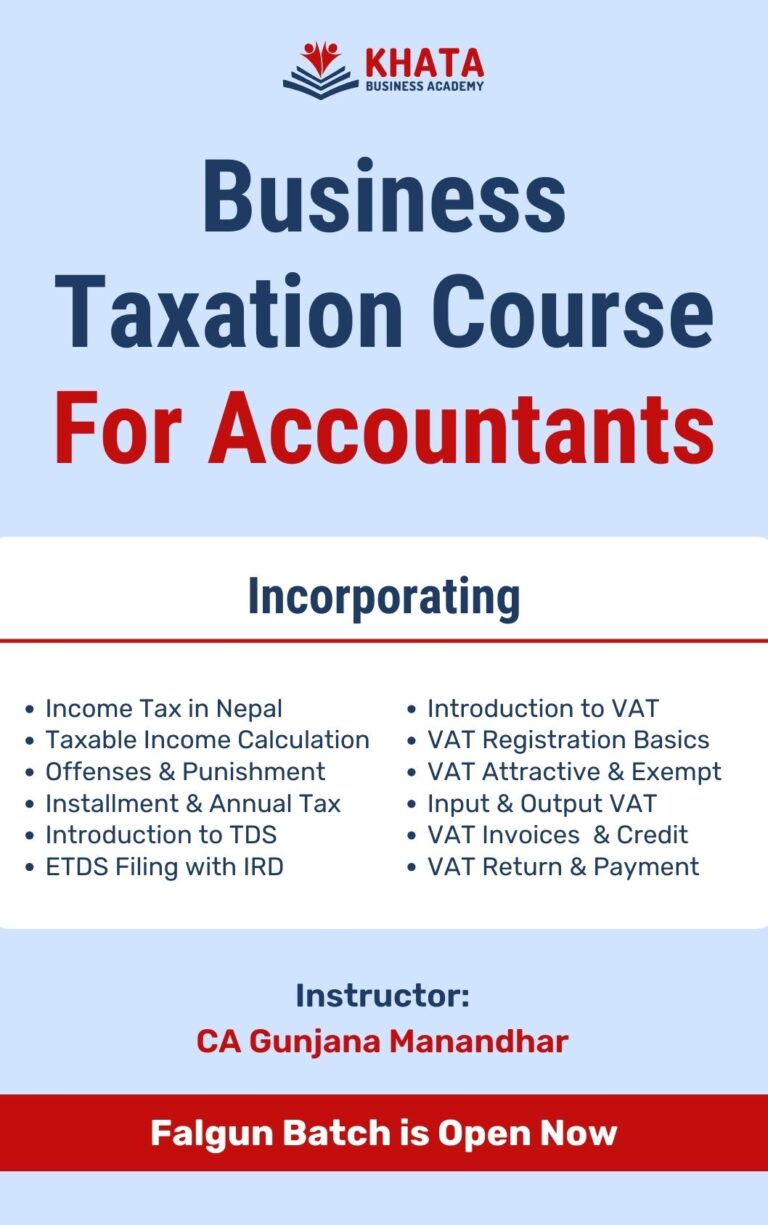

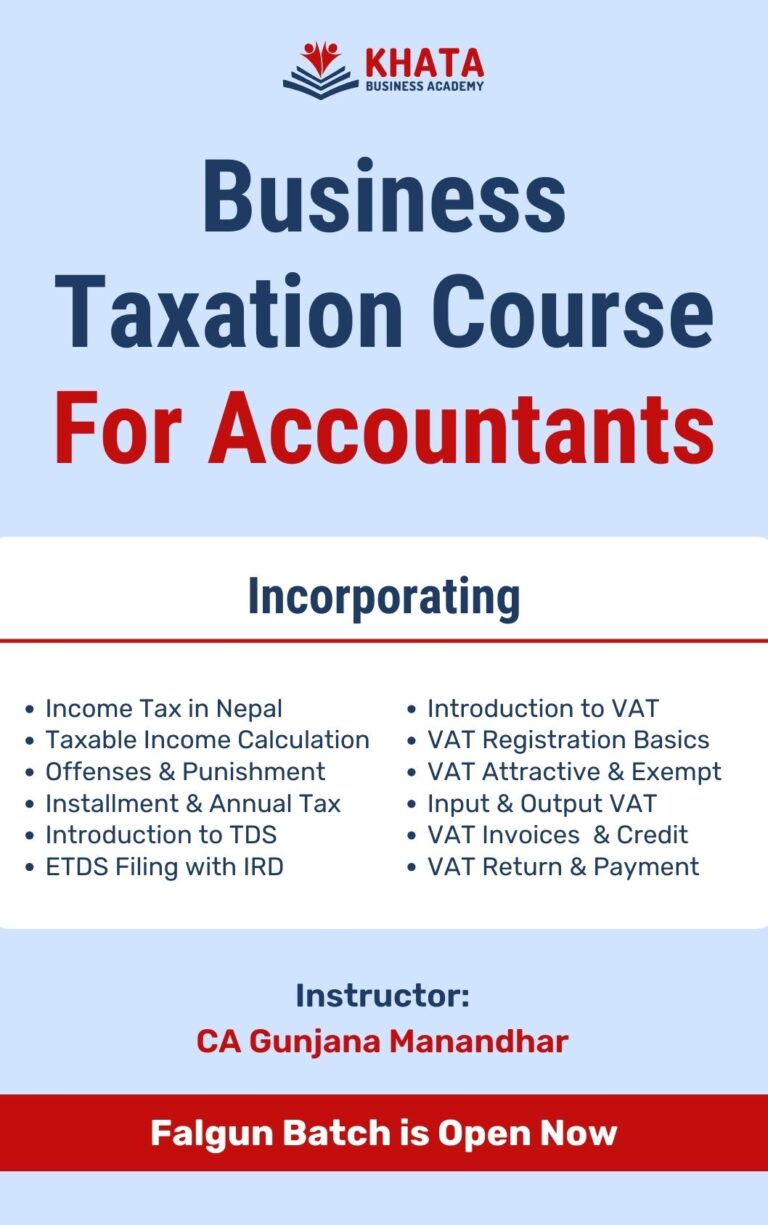

This taxation course is designed for accountants who wish to learn business taxation practically. It covers interactive modules on VAT, TDS, and Income Tax.

Rs. 5,000/-

This Taxation Course is designed for accountants who wish to learn business taxation practically. It covers interactive modules on VAT, TDS and Income Tax.

20 Hours + Live Session

Live + Conceptual Videos

Every Month

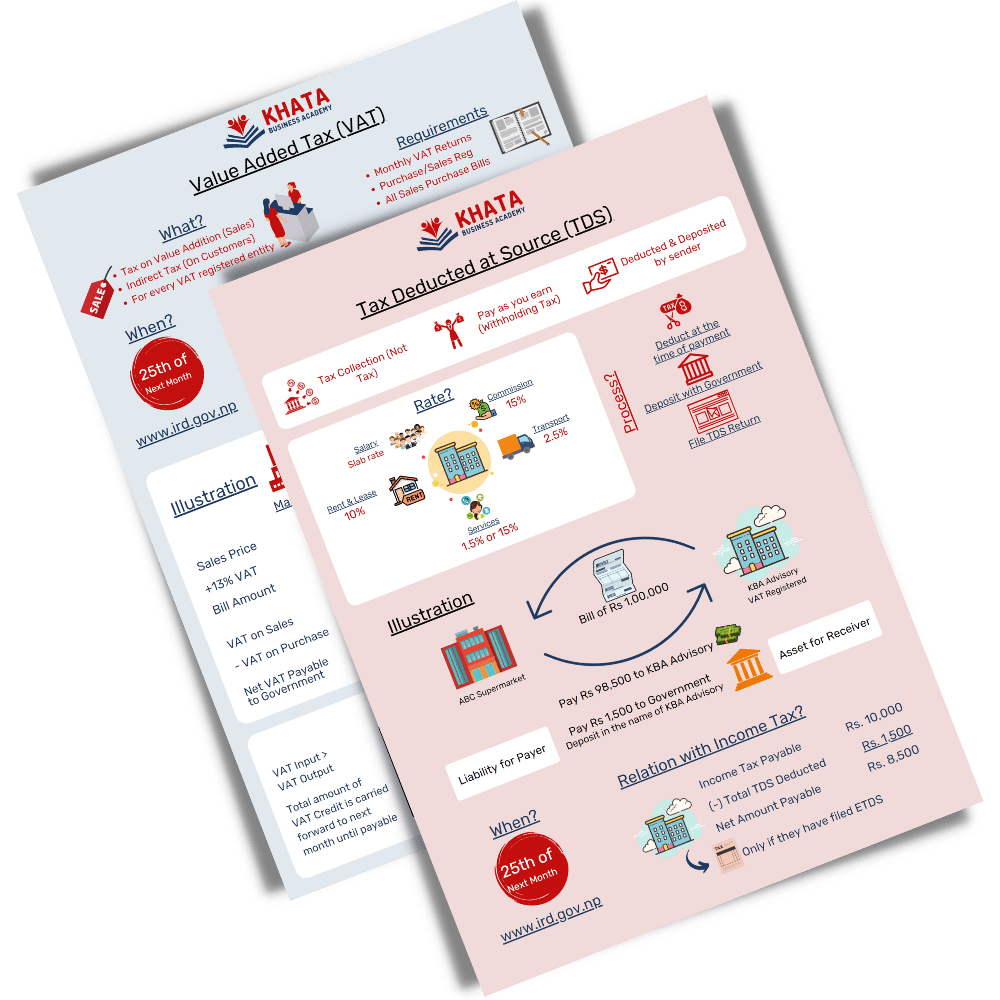

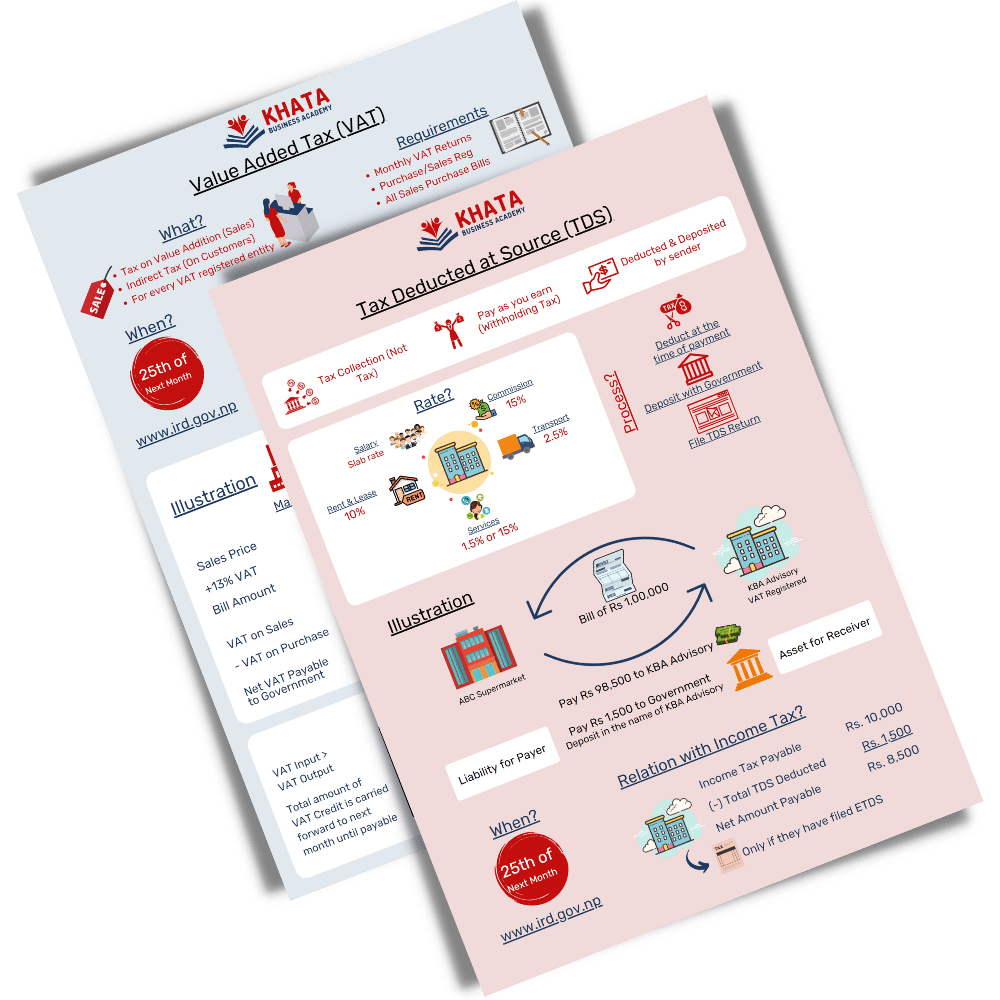

KBA provides you with multiple E-Books and Quick References for your conceptual clarity. Our study materials are often designed with practical illustrations and summarized versions.

Only obtaining theoretical accounting knowledge is not adequate for long-term career growth. We help you with multiple practice templates where you can experiment & learn with real data.

Your learning experience will be maximized with our live sessions in addition to on-demand concept videos. You can interact, discuss real-life queries and clear your confusion.

KBA provides you with multiple E-Books and Quick References for your conceptual clarity. Our study materials are often designed with practical illustrations and summarized versions.

Only obtaining theoretical accounting knowledge is not adequate for long-term career growth. We help you with multiple practice templates where you can experiment & learn with real data.

Your learning experience will be maximized with our on-demand concept videos in addition to live sessions. You can interact, discuss real-life queries and clear your confusion.

This course is exclusively developed and delivered by CA Gunjana Manandhar. She qualified her Chartered Accountancy from ICAI, India in 2017 with All India Rank 49. She then moved to Barclays India where she got an opportunity to work on Taxation & Finance. In 2019, she returned to Nepal and co-founded Khata Business Academy. She has also been involved in the preparation of several other courses in KBA like NFRS For Accountants, Corporate Finance Practicals etc.

Register to join our online learning platform by filling out our inquiry form.

You need to make a payment to access our resources. Once you make payment, kindly send the receipt to us via WhatsApp or any other Social Media

Start learning with our Conceptual Videos, E-Books, and Practice Templates

Clear your doubts and confusion in our interactive live sessions

Once the course is completed, select and attempt the quiz in your portal

Score at least 70% in the assessment test to be eligible for Completion Certificate

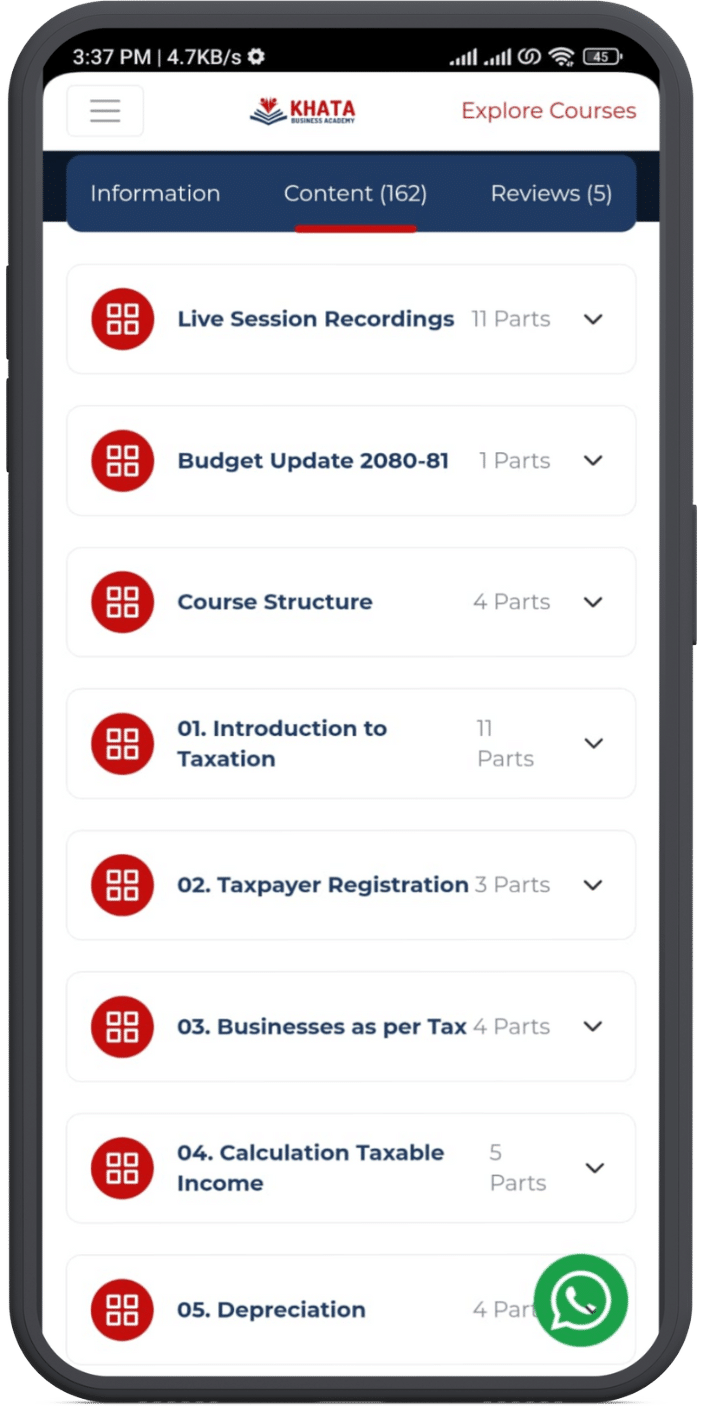

We use On-demand conceptual videos as well as interactive live sessions to deliver our course to our learners. Apart from these videos, we also feature multiple practice templates, E-books & quick references to provide you with practical understanding.

This course is exclusively designed for experienced accountants who wish to enhance their financial reporting skills. You should have at least a basic understanding of how corporate accounting works in real business. Apart from Accountants, this course can also be accessed by Business Interns, Entrepreneurs, Before Pursuing MBA, and so on.

If you are a recent graduate or just planning to start a career in Corporate Accounting, “Learn Practical Accounting” course would be the best choice you.

No, since this course is delivered online, you do not need to visit our learning centers.

Please feel free to fill up the form in the “Enroll Now” section below or contact us directly at 9801074002 for payment and other enrollment matters.

E-Sewa: 9801074001

KHATA BUSINESS ACADEMY PVT LTD

NIC Asia Bank:

A/c No: 1044150060267002

A/c Name: KHATA BUSINESS ACADEMY PVT LTD

Branch: BHARATPUR

You get a job when you convince your interviewer that you are the right candidate for a given profile. We shall certainly help you with the necessary financial reporting skills to enhance your accounting career and promote your current standing in your company.

Please feel free to connect with our course team for any discount or referral-related matters: 9801074002 or https://wa.me/9779801074002

KBA has got you covered! We have a range of Accounting & Taxation courses which you can choose according to your career requirement.

WhatsApp us

Connect with Course Team for Further Process!

Connect with Course Team for Further Process!